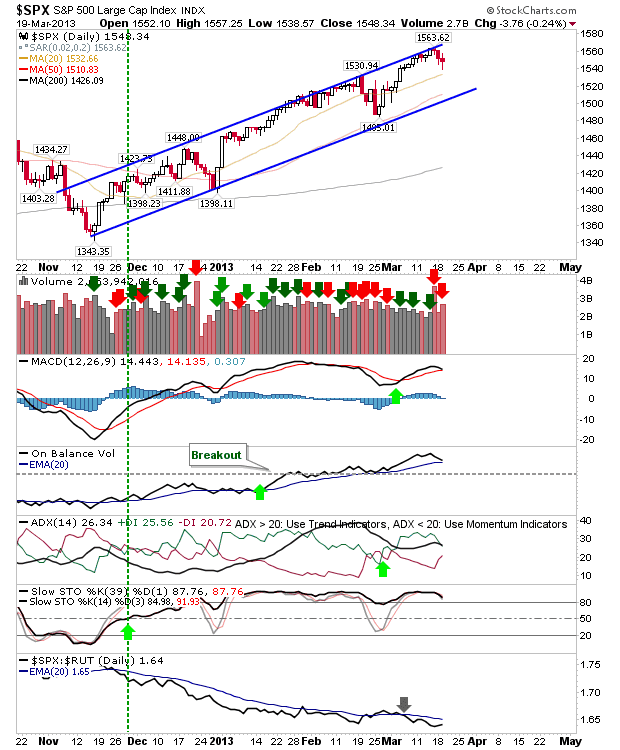

Sellers have taken a shine on the markets since my last update, managing something more than just a couple of points of downside. Volume climbed to register a distribution day, following from some heavy volume trading on Friday.

The S&P eased back off channel resistance, finding temporary relief at the 20-day MA. Technicals haven't rolled to 'sell' triggers yet, marking the resilience of the rally, but also the sustainability in the rate of gain (not too fast, not too slow). A 10% pullback from the last swing high would place the S&P close to its 200-day MA, offering a good pullback buying opportunity.

The Nasdaq is looking more vulnerable to the actions of sellers. It currently trades inside a narrowing (and bearish) wedge. The 50-day MA lurking near wedge support will probably offer the last stand for buyers. A tight stop is suggested if a long position is taken at this point. Technicals are mixed: On-Balance-Volume has effectively remain range bound over the course of the November-March rally; buyers just haven't taken to Technology stocks and are unlikely to start doing so now (or not at least a more substantial pullback emerges).

Feeding the weakness is an increasing bearish turn in the Percentage of Nasdaq Stocks above the 50-day MA. Technicals have been net bearish for this breadth indicator since late February.

The semiconductor index, which was the last bastion of support for the Nasdaq, has sharply turned bearish. A 'bull trap' combined with 'sell' triggers in MACD, ADX and CCI looks to have killed the momentum it had up to this point. The 50-day MA and channel support are the the next stopping points on the way down. As it has behaved better than the Nasdaq, those interested in Technology stocks could look to play a bounce off channel support.

The Russell 2000, while down, has yet to make a test of its 20-day MA. It is currently playing resistance off what was once support. It will take a while for bears to gain control of this index, so this could get scrappy over the next few weeks.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!