Daily Market Commentary: Gains Hold into Thanksgiving

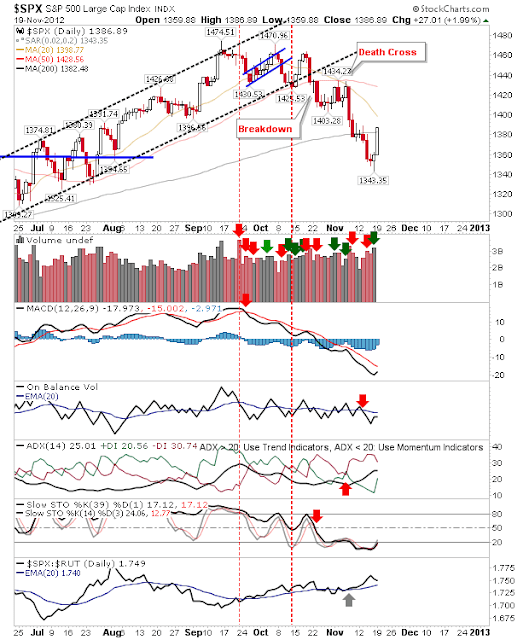

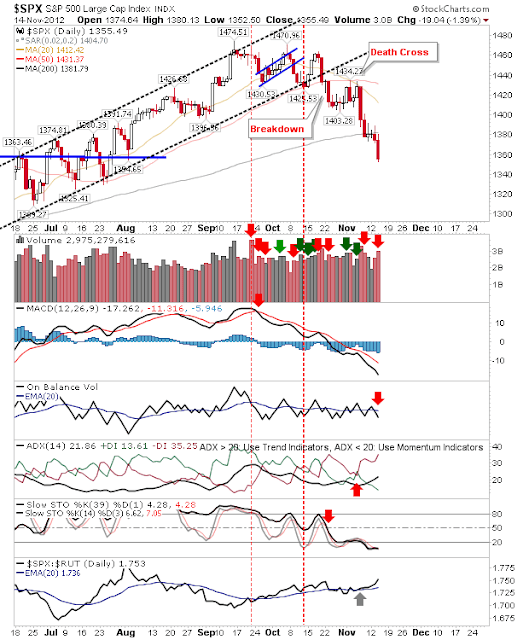

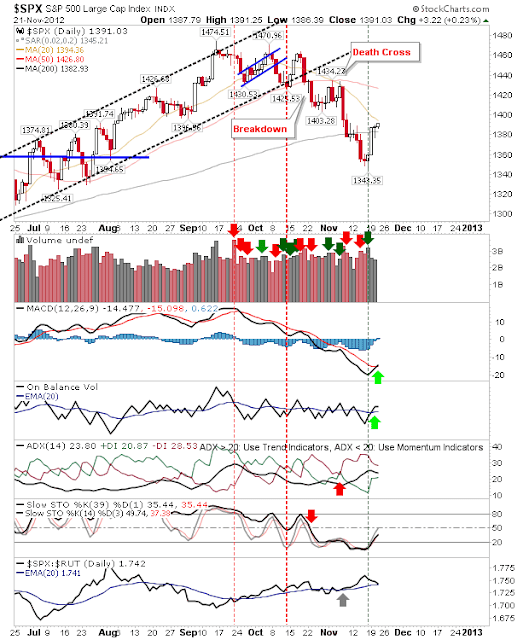

In a quiet day for the markets, all managed to retain the gains booked on Monday. There were some technical improvements, notably the MACD trigger 'buys' for the Nasdaq, Nasdaq 100, Russell 2000 and S&P. Only the Dow Jones was excluded from the MACD love in. The upcoming challenge for these indices are 20-day MAs. The Nasdaq enjoyed an On-Balance-Volume 'buy' trigger to go with the MACD 'buy'. The Russell 2000 got a relative strength boost against the Nasdaq, and managed a gain against the S&P. Better stuff from speculative Small Caps, and suggests there is more to this rally than just a simple bounce. Friday will boil down to action at 20-day MAs, but holiday trading could see these ignored in some Black Friday bargain hunting. Next Monday will give a better reflection as to how this rally is shaping up. Have a great Thanksgiving! --- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director ...