Daily Market Commentary: Low Volume Consolidation

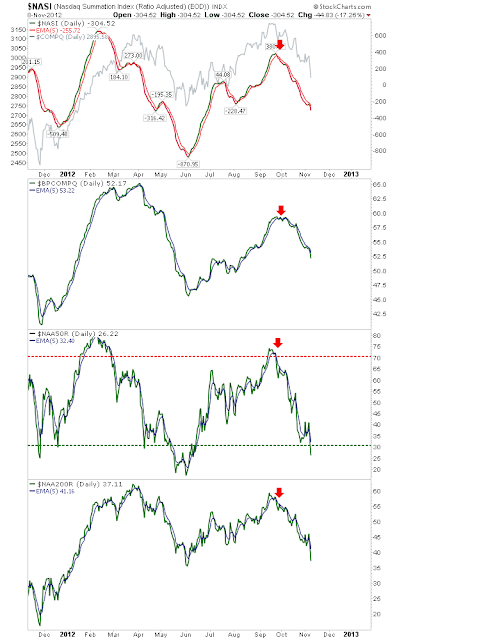

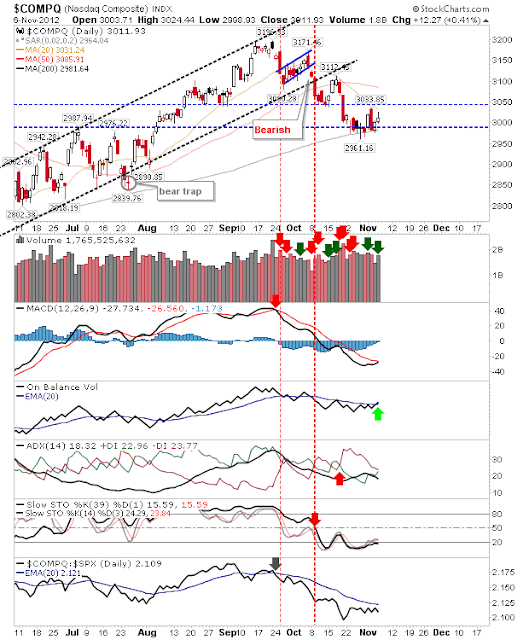

Light trading over the Veteran's day holiday did little to change the broader picture. The S&P remained at its 200-day MA, generating what looks like a whipsaw signal for on-balance-volume. The S&P remains the last of the key indices to hold this moving average, it will be a difficult task for it to hold in such light. The Nasdaq posted a small loss, but it looks ready to make another leg lower. While the Russell 2000 will be looking for support around 760. It currently trades around a minor support level of 795. Today's trading was clouded somewhat by the holiday. Tomorrow will give a clearer picture as to what the week holds. Breadth does not suggest a significant swing low is in play, but a relief rally is well within the realms of possibility. --- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com . I offer a range of stock trading strategies for global markets which can be Prev...