Daily Market Commentary: Buyers Attempt a Stand

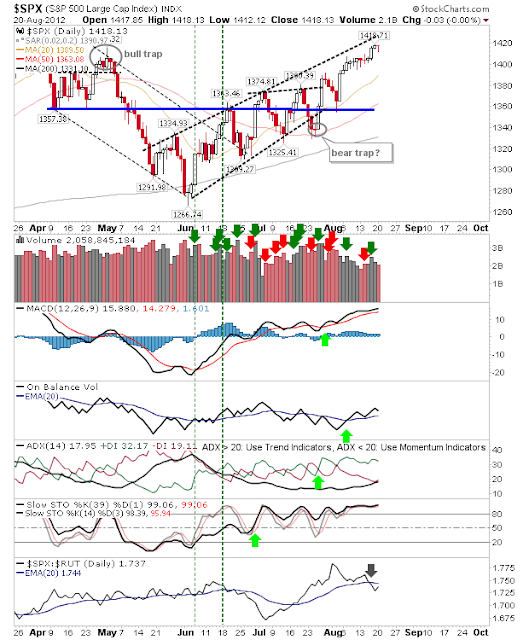

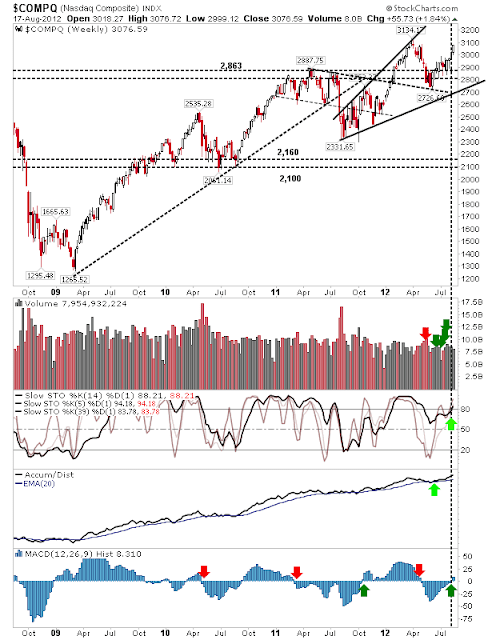

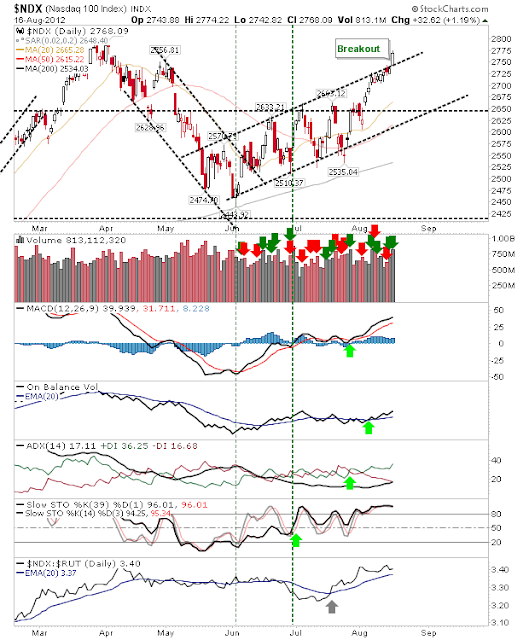

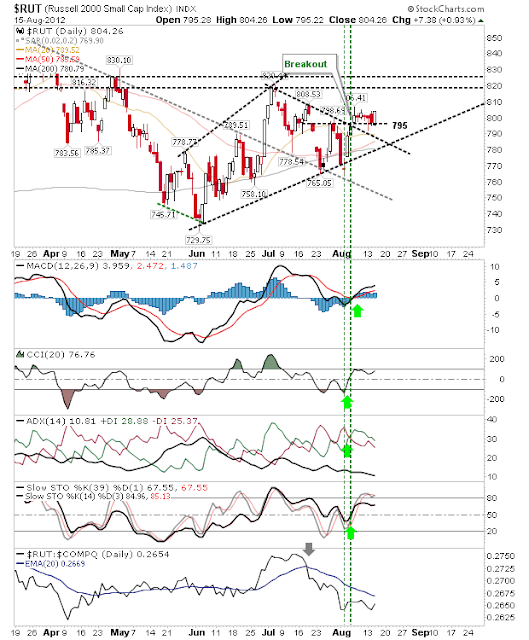

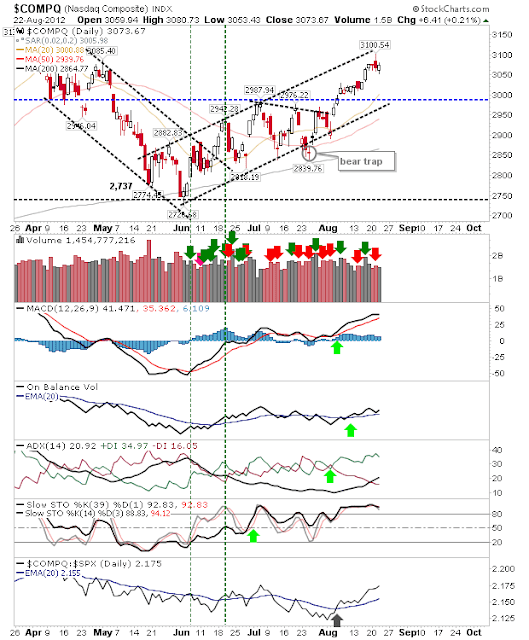

Not sure buyers are coming in a little early on this? But after Tuesday's sharp intraday reversal it had looked likely markets were going to take a little breather. Instead, bulls took markets off their lows and back to Tuesday's close - or slightly higher. Volume was lighter, so there wasn't a whole lot of conviction to the buying. The Nasdaq had the best of the buying, keeping the July rally on track towards testing channel resistance. Technical strength remains good. The Russell 2000 was the day's underperformer. It closed lower, but had managed to claw back some of the day's losses. It remains primed to break past the June swing high (long ago breached for the S&P and Nasdaq) and has plenty of support to look too at 795, 20-day and 50-day MAs. The S&P was effectively caught in the middle. Closing on a doji and in a position where it could go either way. Tuesday's high effectively touched channel resistance, so the scales ...