Daily Market Commentary: Modest Recovery

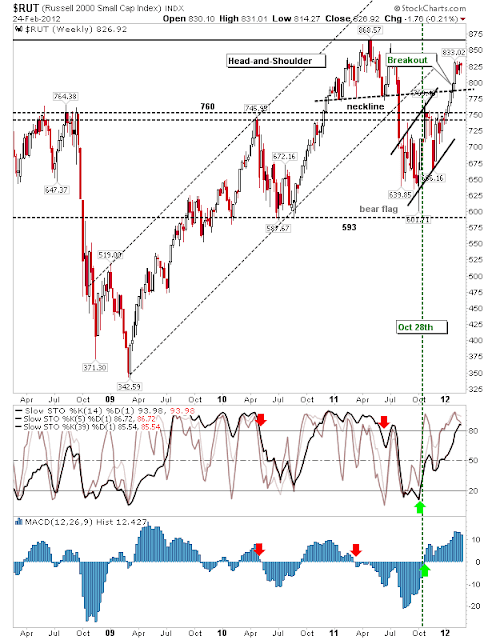

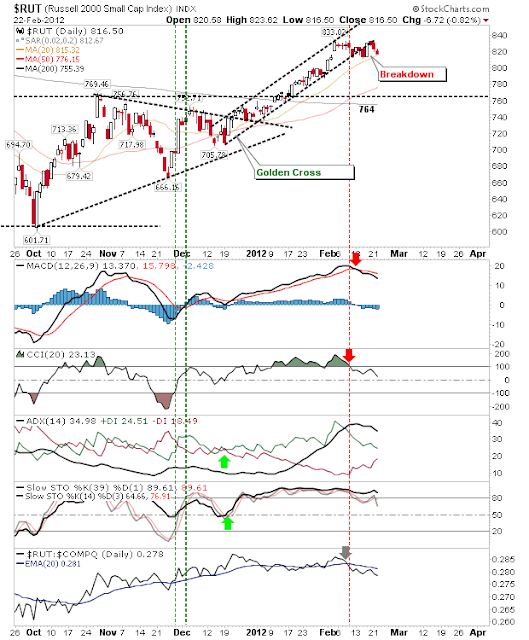

The S&P made inroads into yesterday's losses, but Small Caps finished near the lows of the day after an intraday recovery. Bears hold the advantage from yesterday with buying volume well down on yesterday's selling. The S&P held its rising channel as relative strength expanded towards Large Caps over Small Caps. Technical strength remains healthy. The Nasdaq is clinging on to channel support and is offering enough for a short term buy, but with a tight stop. But its the Russell 2000 which perhaps offers the most for shorts. The sideways consolidation hasn't confirmed a break, but a loss of 814 would give shorts something to work with. The Semiconductors are also looking vulnerable to a more protracted decline having already lost the rising trendline. The 50-day MA is looking the most likely downward target. Despite today's gain it's sellers which hold the advantage. Buying into the Nasdaq and Nasdaq 100 does not seem as attractive as ...