Daily Market Commentary: Small Caps and Semiconductors Suffer

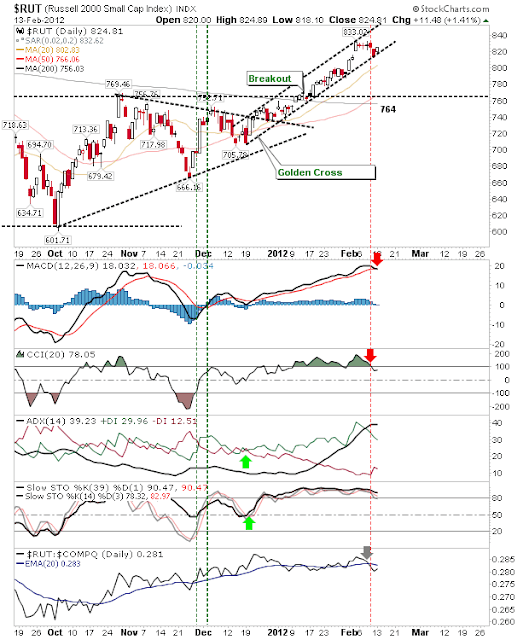

Where Large Caps and Tech were relatively unchanged by the close, it was left to Small Caps and Semiconductors to fire the warning shots. Action in the Russell 2000 was the most worrisome. Tuesday's loss didn't quite reach the 1% mark, but it did confirm the channel breakdown (and removing what had looked to have been a 'bear trap'). The 20-day MA is the next point of support; a second down day here will see this MA tested. The semiconductor index was one of the harder hit sectors. Tuesday's loss is the second sizable loss for this index in a row. It has come close to a confirmed break of the December 2011-February 2012 trend, although I would give this a little more leeway. Technicals remain bearish. Should early weakness in semiconductors expand into a broader decline, then expect this selling to spread to the Nasdaq and Nasdaq 100. For Wednesday, watch the two aforementioned indices closely. What happens here will have significant impacts on Tech