Daily Market Commentary: S&P Test of 20-day MA

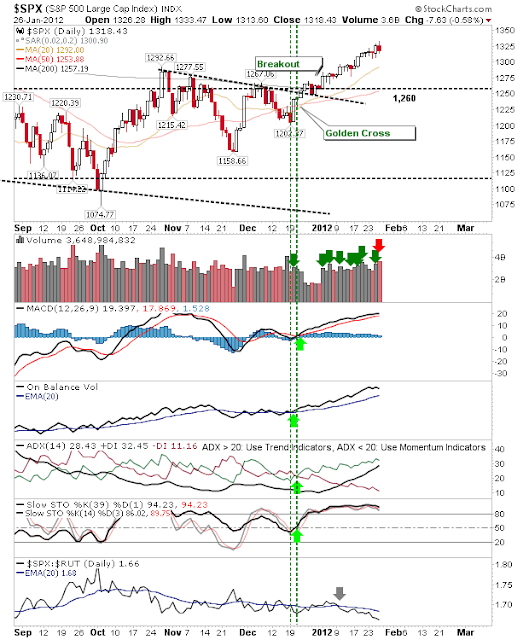

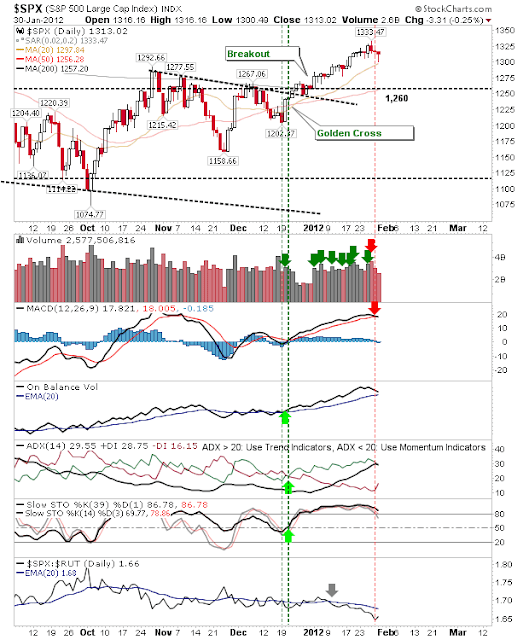

The early morning dive across markets took the S&P and Dow Jones Index down to their respective 20-day MAs. All indices were able to recover by the close, but not before triggering technical 'sell' signals for MACDs for the aforementioned indices. Bull can take comfort from the sharp drop in trade volume; it was well below that of last week and didn't rank as distribution. Today's touch of the 20-day MA in the S&P looks like a successful support test, but should there be a second test this week then it will likely break and the 50-day MA becomes the next support level. Trading in the Nasdaq was more robust. The index was able to close inside Friday's range and is well above its 20-day MA. Technicals remain bullish. Because the Russell 2000 didn't suffer the same losses at the open it did close down, although the net loss from Friday was slight. Monday's trading is in line with typical bullish behavior; i.e. small losses on low volume