After the extremes (at least on the daily timeframe) of last week it was inevitable there was going to be a fall. Early European action suggest there will be some follow through today.

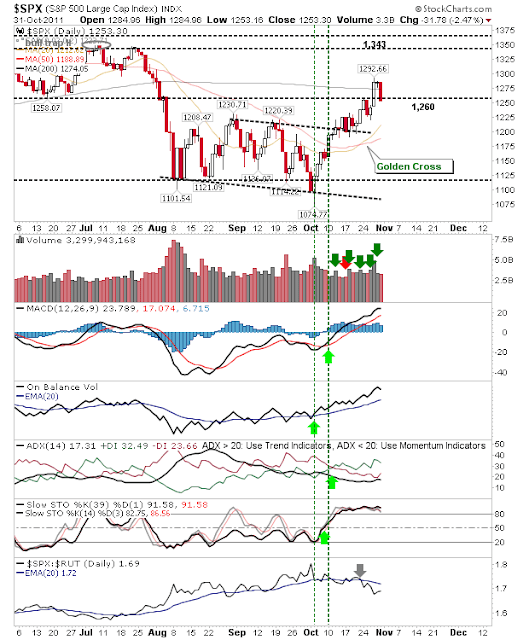

The S&P lost 200-day MA and the break of 1,260 support, trapping buyers above 1,260, but doing so without generating panic selling (trading volume was light). Of greater importance is how the index behaves when it makes it back to the 20-day MA or 50-day MA. Monday's loss is a warning shot, but nothing out of the norm.

The Nasdaq has more breathing room despite the nearly 2% loss. Monday's finish saw 200-day MA honored with the 20-day MA fast approaching significant support at 2,616. Tech averages remain in good health and yesterday's selling did little to change that.

The Russell 2000 has managed to outperform the Nasdaq in recent weeks, although it did so from a much weaker starting point. The index maintained its break of 731 but as yet to challenge its 200-day MA - this may take a while yet to happen.

The other index to keep an eye on is the semiconductor index. It closed inside a thick band of support between 380-390 but the 20-day MA is some distance away from lending support. It will be important for the health of the Nasdaq and Nasdaq 100 for this to hold 380 over the next couple of days.

Monday's action was typical profit taking, but it will be important selling volume doesn't pick up pace to the downside. Sideline money is unlikely to want to get involved until the level of demand is known on next tests of 20-day and/or 50-day MAs.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!