Daily Market Commentary: Gain - What Gain?

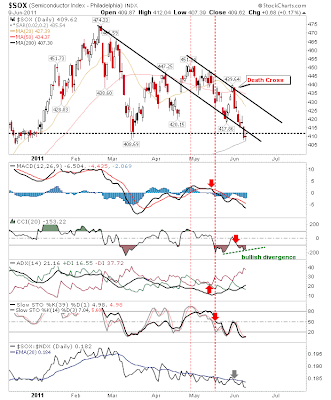

In the game of one-upmanship bears raised the stake once more, pushing indices back to, and in some cases, beyond yesterday's starting prices; each swing becoming ever more volatile. It still doesn't change the situation that a bounce of substance is more favoured in the short term, especially with significant support still available to lean on. The S&P posted a new low for the decline from April highs but it remained above 1,260 and 200-day MA support. Volume climbed to register another distribution day. One only has to look at the chart to see how many distribution days have passed since the April top. Today was ugly, but bulls still have support to work with. The Nasdaq returned to its 200-day MA after yesterday's weak bounce as volume rose significantly to mark a distribution day. Bulls next line of defense is 2,616. But bulls may not find the 200-day MA of the Nasdaq so forgiving. In the Nasdaq 100 the 200-day MA was cleanly sliced as it finished on March s...