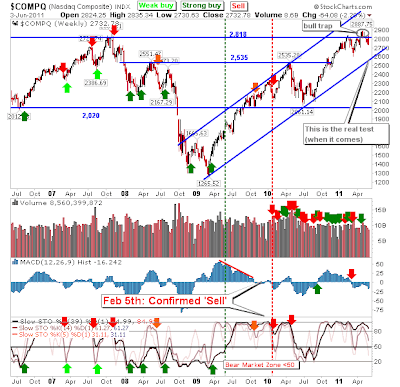

Weekly Market Commentary: Bull Traps in Nasdaq and Small Caps

Finally have internet hooked up so its nose to the grindstone again! There were two significant reversals on the weekly time frame from my last update. First up is the bull trap in the Nasdaq; defined by 2,818. The break above, then below this level occurred within a broader bullish channel. It's not a disaster for bulls but it's a clear shot across the bows. The test of rising channel will be a more important battle for bulls. The Nasdaq 100 was not as susceptible to the bull trap as it's sister Nasdaq. The threshold for support is 2,217 which is still a good 65 points away. Losses of the past month are more likely to represent a broadening of the 9-month trading range - but what happens elsewhere will ultimately influence if 2,217 support can hold. The Percentage of Nasdaq Stocks on point-n-figure 'buy' signals dropped below the bullish 60% mark to a more neutral stance. While the Percentage of Nasdaq Stocks above the 50-day MA is down at 34%, but well