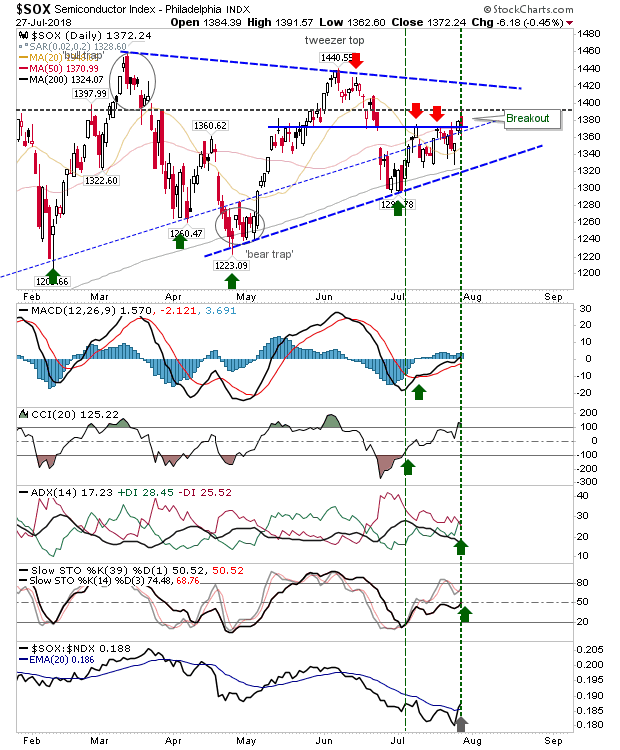

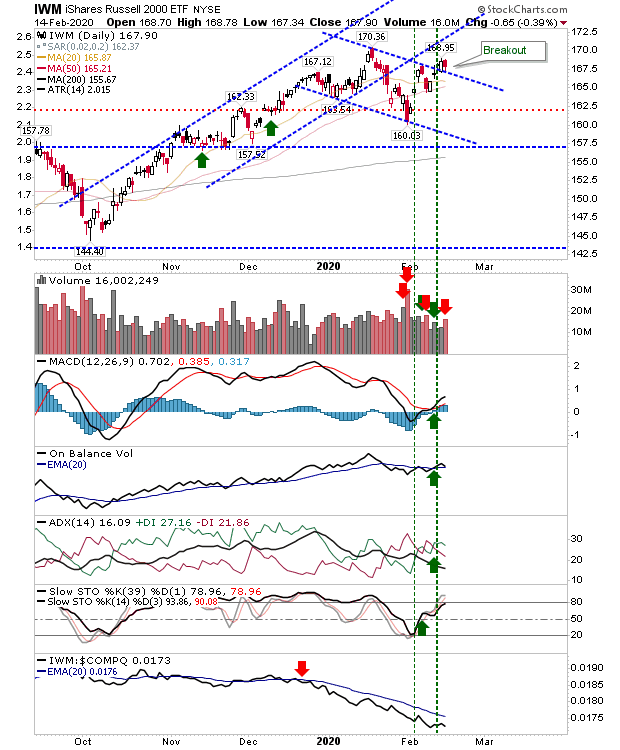

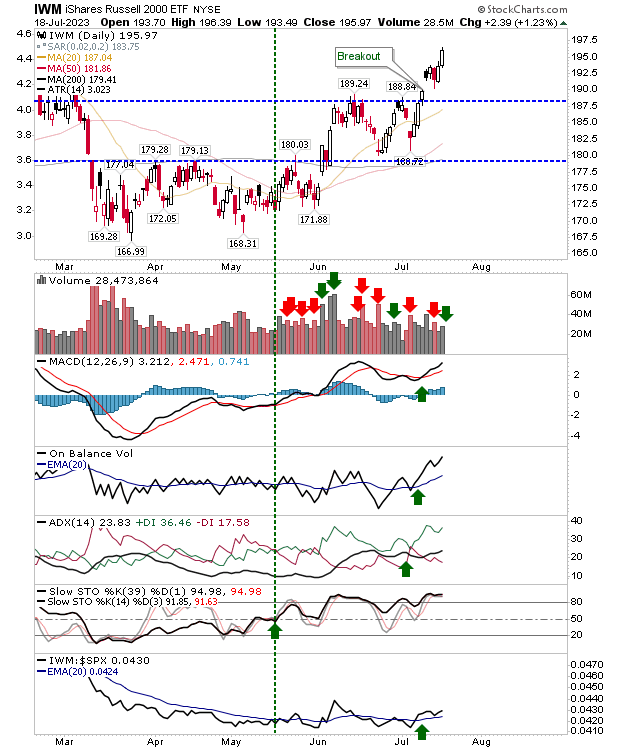

Finally, bulls make their move. The Nasdaq enjoyed a clean channel breakout with a solid move higher - even if volume was a little disappointing. First test will be the 20-day MA overhead. The Russell 2000 also enjoyed a channel breakout, matched with a CCI 'buy' signal. The semiconductor index is up against the 20-day MA which will be a big test for the other indices for the early part of next week. The S&P only managed to push just beyond channel resistance, but a shift in relative strength towards more speculative small caps is a bullish sign. So with the shift we now have the most bullish alignment for markets with small caps leading tech leading large caps. Look for more gains Friday. Dr. Declan Fallon, Senior Market Technician for Zignals.com , offers a range of stock trading strategies for global markets under the user id: ‘Fallond’, ‘ETFTrader’ and ‘Z_Strategy’ available through the latest rich internet application for finance, the Zignals Dashboard ; many are rank...