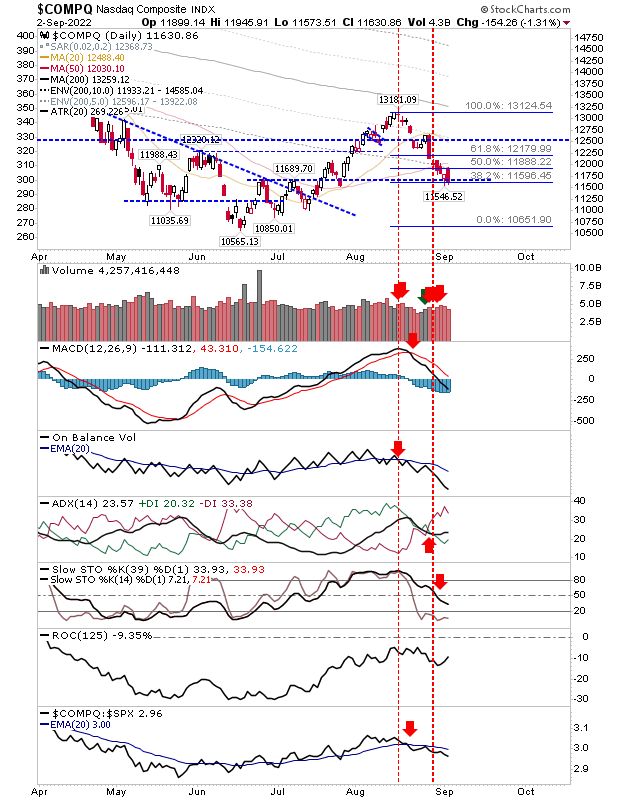

Fibonacci bounce chalks up a third day on close above 50-day MAs

Bulls will be happy the bounce managed to add another day, but the buying volume remained disappointing. However, we did see easy breaks of 50-day MAs, which opens up moves to 200-day MAs and/or August highs. Whether we ge there will largely be determined by buyers stepping in with volume, but we can let price action drive momentum for now. The S&P added to the bullish momentum with a new 'buy' trigger in the ADX, but other technicals remain bearish. The index is just above holding on to its relative performance advantage against the Russell 2000 - but is on the verge of an underperformance switch to this index. The other indicator to watch (which I don't mention much) is the Rate-of-Change (ROC). If ROC can return above '0' it would mark a cyclical return for bulls.