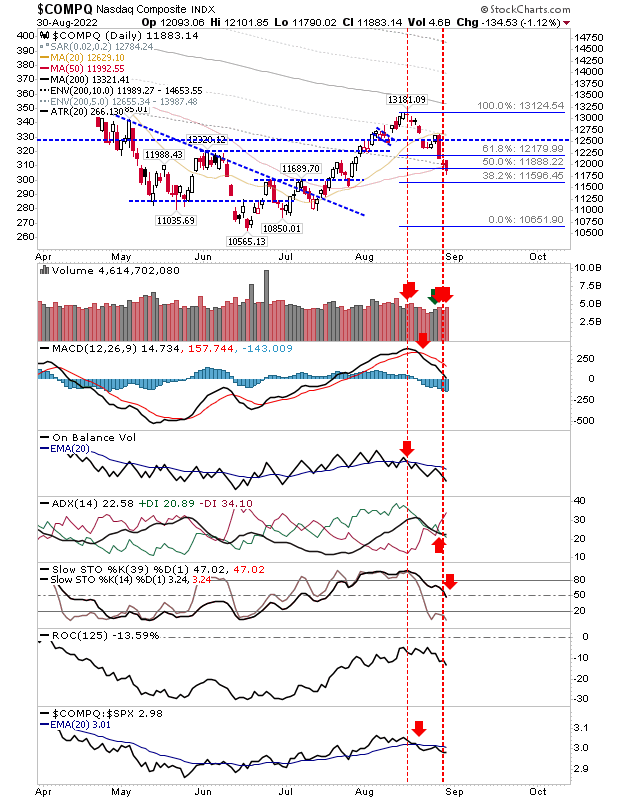

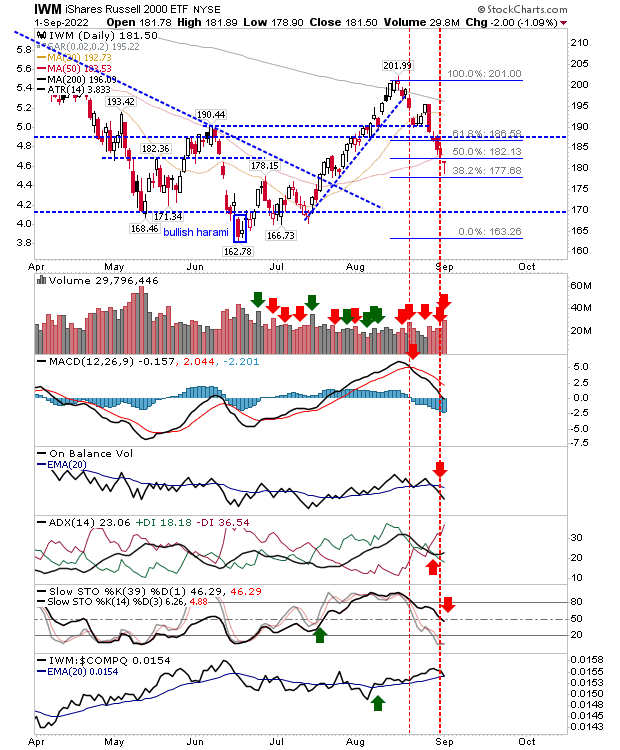

Silver lining? Bullish hammers at Fib retracements for lead indices

If there was a setup for a bullish reversal in the indices then today was the day. The Russell 2000, Nasdaq and S&P all closed with bullish reversal candlesticks down at the 61.8% Fib retracement of the move from June through August. However, any further loss would open the possibility for a complete retracement to the June low. The Russell 2000 finished the day with a doji on higher volume distribution. Stochastics finished just below the mid-line, resulting in a net bearish technical picture - but these same stochastics are at a level where rallies in bull phases occur (the Russell 2000 having jumped to the bullish side of this equation in July).