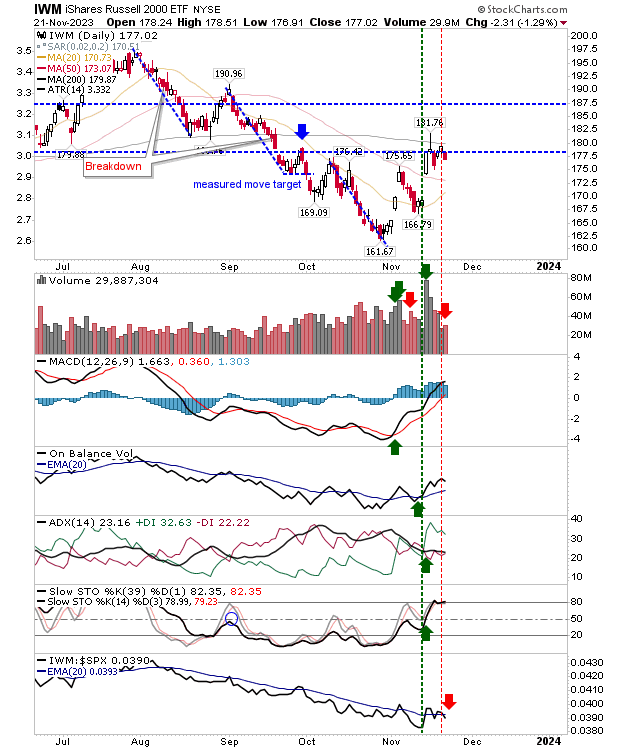

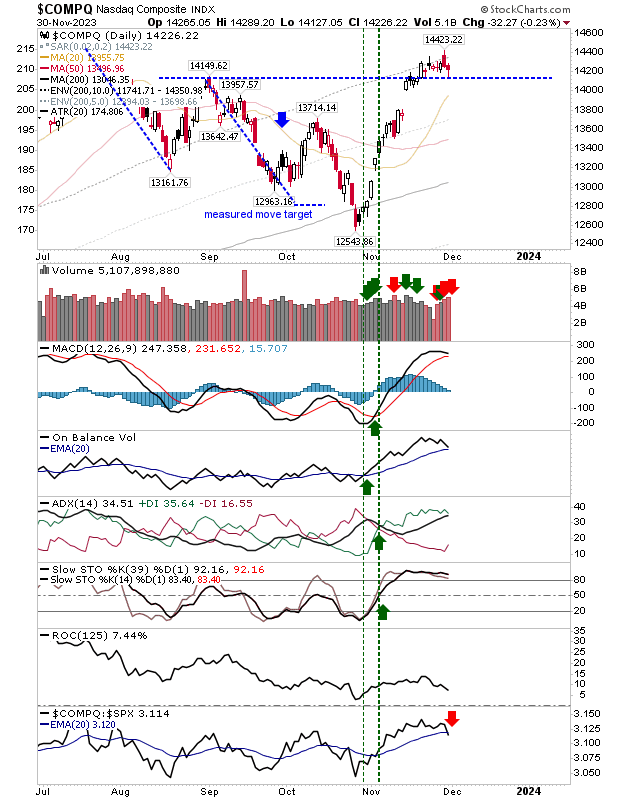

Markets in "covered call" territory

Bulls have managed to retain control of their powerful rally off October lows. Shorts looked ready to attack with yesterday's bearish 'cloud cover' candestick in the Nasdaq and S&P, but today's action has managed to counter that without really changing the larger picture. If you held index ETFs then current action would be a decent opportunity to sell covered calls against your position. There may be some pullback, but it's hard to see any selling going all the way back to those October lows.