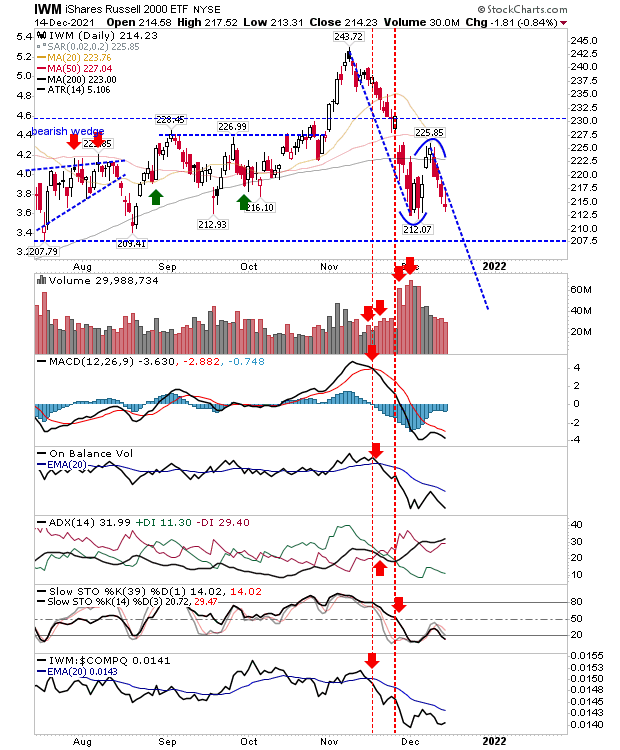

Russell 2000 approaches December low

If we are going to see buyers step in to defend the December swing low for the Russell 2000, then they will need to start buying now. Today delivered the fourth day of selling in a row and only the drop in selling volume offers a suggestion the desire to sell may be on the wane. Technicals for the index remain net negative and relative performance hasn't improved much since the December low was defined. A continuation of the measured move lower remains the preferred outcome here.

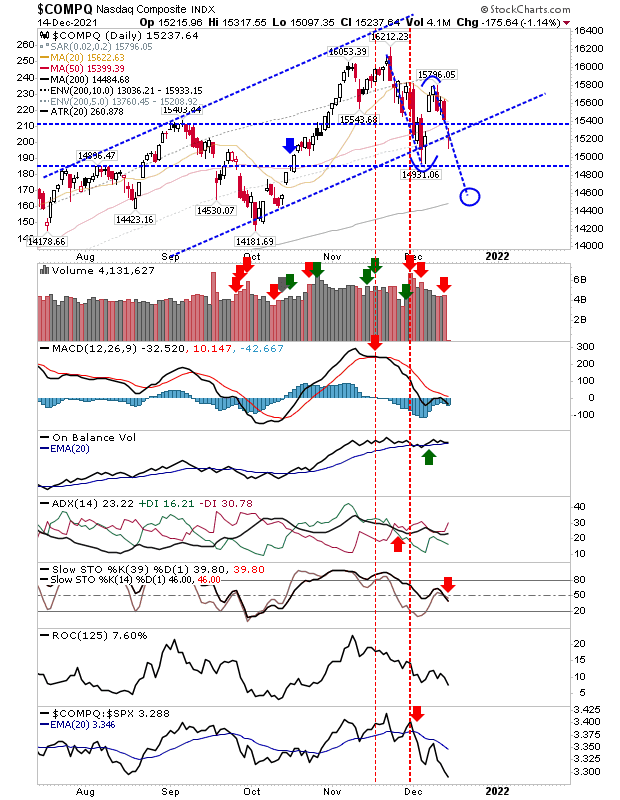

The Nasdaq similarly has a measured move target to aim for - and that target corresponds to the 200-day MA, so there is a good chance we will see this tested over the coming weeks. Stochastics have returned below the bullish mid-line - effectively confirming a bear market, while relative performance (to the S&P) is falling off a cliff.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.