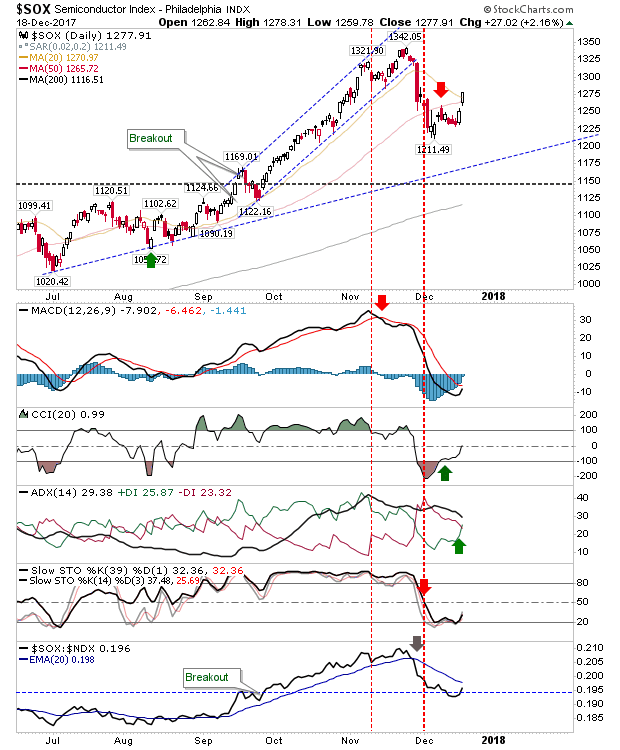

Semiconductors Force Short Covering

Shorts holding on to their short positions in the Semiconductor Index on Friday were made cover today. Today offered a positive break of the 50-day MA with a gap move. Technicals improved although there is still some work to do to change the MACD and Stochastics to a bullish 'buy' trigger.

The Russell 2000 accelerated its gains to effectively negate the 'Bull Trap' in a single day's gain. There was also a new MACD trigger 'buy' to go with the +DI/-DI. The momentum is there for a move to channel resistance and there is enough time before end-of-year for that move to happen.

The Dow short play from Friday didn't get off the ground as the morning gap higher will have dissuaded new positions and forced existing shorts to cover. Volume wasn't great but Technicals are suggesting this may not be moving into a rally acceleration.

The S&P gapped higher but as it wasn't a natural resistance level it didn't attract much attention. Longs holding from the 'bear trap' trade will be looking for a tag of the parallel channel resistance.

For tomorrow - and the rest of the week - look for more of these slow-and-steady gains on light volume. Shorts don't really have much to work with.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The Russell 2000 accelerated its gains to effectively negate the 'Bull Trap' in a single day's gain. There was also a new MACD trigger 'buy' to go with the +DI/-DI. The momentum is there for a move to channel resistance and there is enough time before end-of-year for that move to happen.

The Dow short play from Friday didn't get off the ground as the morning gap higher will have dissuaded new positions and forced existing shorts to cover. Volume wasn't great but Technicals are suggesting this may not be moving into a rally acceleration.

The S&P gapped higher but as it wasn't a natural resistance level it didn't attract much attention. Longs holding from the 'bear trap' trade will be looking for a tag of the parallel channel resistance.

For tomorrow - and the rest of the week - look for more of these slow-and-steady gains on light volume. Shorts don't really have much to work with.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

. I invest in my pension fund as a buy-and-hold.