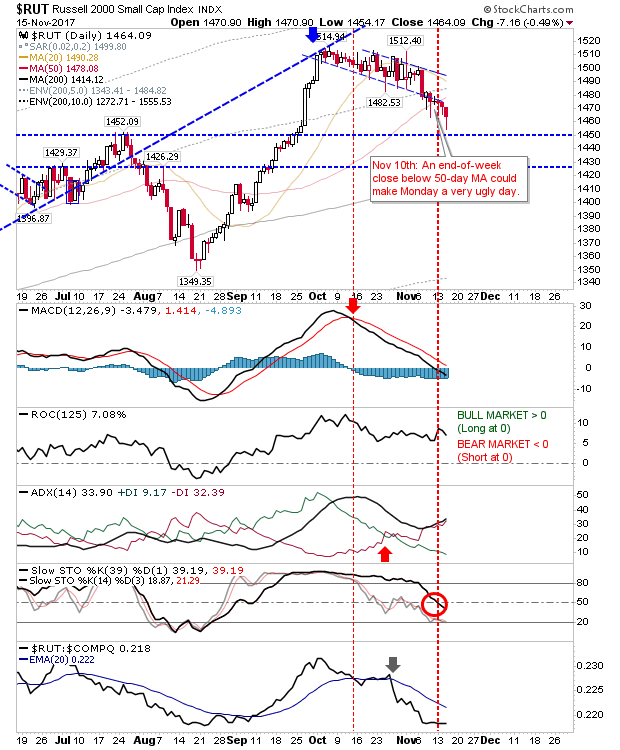

The Russell 2000 was again under pressure as it shed another 0.5%. The Russell 2000 now trades below its 50-day MA despite recovering some of today's intraday losses. It looks like controlled selling with an artificial prop to prevent a rout. The 200-day MA is the next port of call but a 1% loss of more will bring sellers in fast. Technicals are weak but not oversold.

The S&P looks to have confirmed a 'bull trap' with a return inside the prior rising channel. Such action typically results in a move back to rising channel support. First port of call will be the 50-day MA.

The Nasdaq is holding up better than either Small and Large Caps with relative performance ahead of the curve although it has a MACD trigger 'sell' to work off.

The aggressive long in the Dow Jones isn't looking so great. It's still hanging on to support but after a day like yesterday it really should have closed higher. With the S&P already back inside its former rising channel I would be looking for the Dow Jones Index to do the same.

For tomorrow, look for an acceleration of selling in the Russell 2000, a drop inside the former channel for the Dow Jones and drip losses in the S&P. If premarket suggest bulls are going to be in control (e.g. a gap higher) then the Nasdaq may be the better index to trade. However, if the S&P can gain enough to bring itself to challenge the 'bull trap' then it will also be a good long trade (in essence, switching from a current 'bull trap' to a 'bear trap').

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on

eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.