Daily Market Commentary: Bears Smash-and-Grab

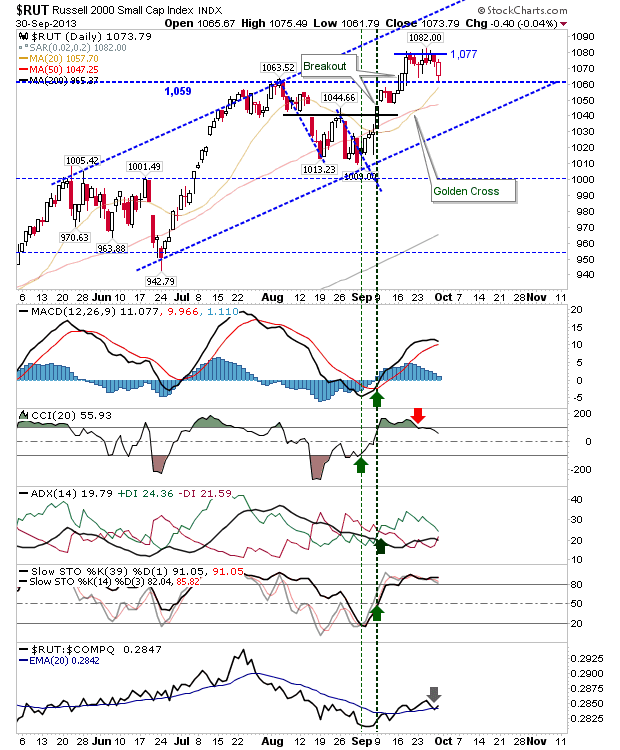

It wasn't pretty - bears played all their cards at market open - but bulls clawed things back (somewhat). The Russell 2000, as the most bullish index, managed to reclaim most of the opening gap loss. The Russell 2000 successfully tested breakout support at 1,059 with the 20-day MA fast approaching to offer additional support. Technicals are okay too, despite weakness in price. Tomorrow is another chance for bulls, but buyers won't tolerate too many days like today. Stop placement remains on a loss of 1,059.