Daily Market Commentary: Election Buying

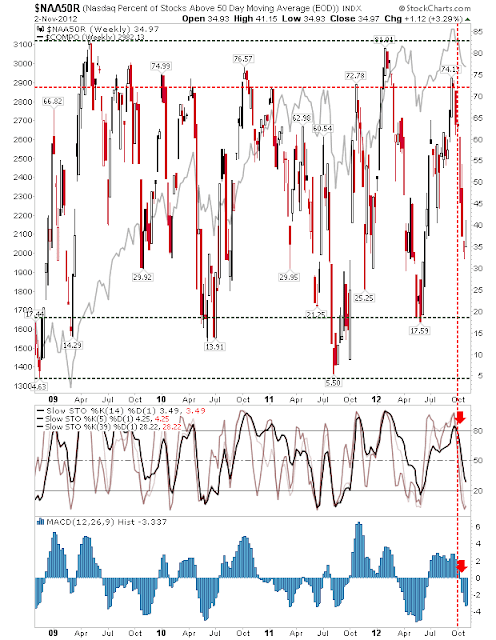

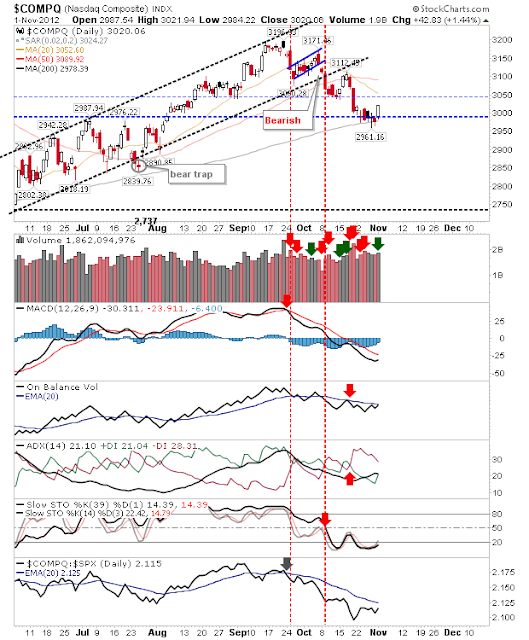

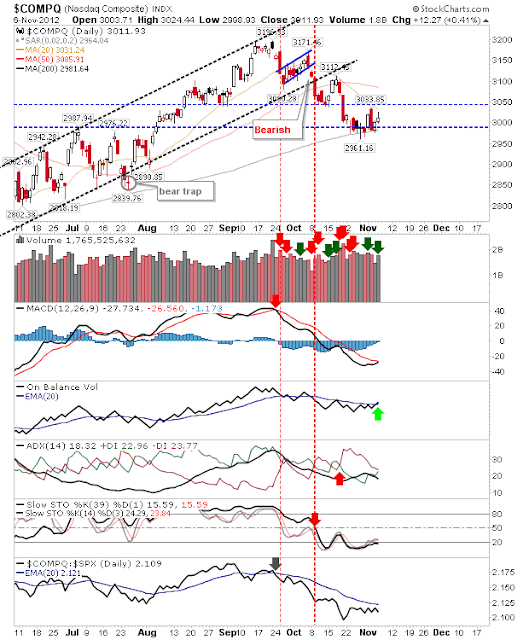

Now that the dust has settled on the election, and life can get back to normal for those in Ohio, a quick look at the market gave bulls some hope. Yesterday was a day when buyers were able to grab some bargains before they sat themselves in front of the television to watch results. Volume increased, which marked yesterday as an accumulation day. Futures also suggest some follow through from the open. However, it wasn't as good as it had one time looked during the day. The Nasdaq gave back a large portion of its intraday gain by the close of business, finding resistance at its 20-day MA. This for an index working off a natural support level of a 200-day MA. A tough struggle may ensue here. In the bull column, there is a strengthening swing low in the Percentage of Nasdaq Stocks above 50-day MA, helped by a fresh MACD trigger 'buy'. The Russell 2000 enjoyed a decent day, falling shy of a 1% gain. But it does sit on the verge of a MACD trigger 'buy'.