Another exciting week goes by; but has anyone the edge?

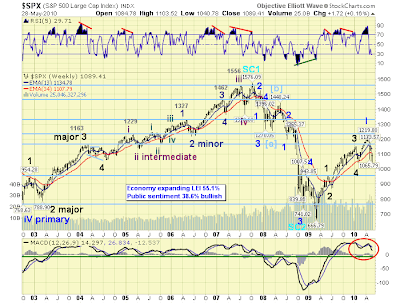

Anthony V Caldaro of

http://objectiveelliottwave.com/ has checked this week; noting the bearish divergence in the MACD, but not changing any of his prior wave counts.

Richard Lehman of

TrendChannelMagic.com points towards a flat consolidation, but worries if the mild rally doesn't make it up to larger channel resistance c1,120 for the S&P.

5/28 --Even with Thursday's huge advance, the week's action shows flatter short term upchannels than were first indicated. There are still a couple of different angles possible, but they are relatively flat and may alllow more weakness early next week before rising again. If the Dow is going to get to 10,500 and the SPX to 1120, it will now take longer at this angle (i.e. most of next week). If the indexes reverse before even reaching the upper green channel lines, it will be rather negative, as it may suggest that the green channel is accelerating downward. So, unless the momentum is going to enable an upward break, the indexes will encounter resistance fairly soon and reverse down again.

Another free copy of the Channelist Newsletter will go out this weekend. If you are not already receiving them, e-mail info@trendchannelmagic to be added.

5/27 -- Riskier groups of equities had a banner day with impressive gains of 4-5%, though all of it still in the context of a downchannel with successively lower peaks. We will very soon test the upper lines of this downchannel and see whether there is going to be a possibility of breaking north again in the short term. Essentially, XTC, XLE, XLK have already hit that upper line in one of their charts and others are not far behind. (The Dow would hit at 10,500 or so and the SPX at 1120. I think we will get some clues Friday, though I doubt there will be too much interest in being overly long over a three-day weekend.

Yong Pan of

Cobrasmarketview has gone decidely neutral (with a few bearish signals in the mix) on the short and intermediate term.

The autotrade system covered the short position and is waiting for a new signal.

Has the Put/Call Ratio to the S&P gone from one extreme to the other (now oversold)? Note also resistance line break; long side opportunity?

Yong Pan sees bulls as having the edge to push further gains based on candlestick characteristics

Michael G. Eckert of

EWTrendsandcharts has labelled a 5-wave down with the third wave of the five in play. It has a downside target c925 which is perhaps one of the more bearish outlooks out there. For it to be true then 1,125 cannot be violated to the upside.

Joe Reed offers his weekly summary:

Note how oversold the Nasdaq Summation Index is - appears to be very close to a 'buy' based on Full Stochastics

So short terms still look to run bulls favour, but it's not all consensus from commentators. When markets leave oversold conditions will offer a truer measure of demand and what can be achieved by buyers.

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for

Zignals.com, offers a range of stock

trading strategies for global markets, also available through the latest rich internet application for finance, the

Zignals MarketPortal or the Zignals

Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock list watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too.

Build your own

trading system and sell your

trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on

Investimonials.com.

JOIN US TODAY - IT'S FREE!