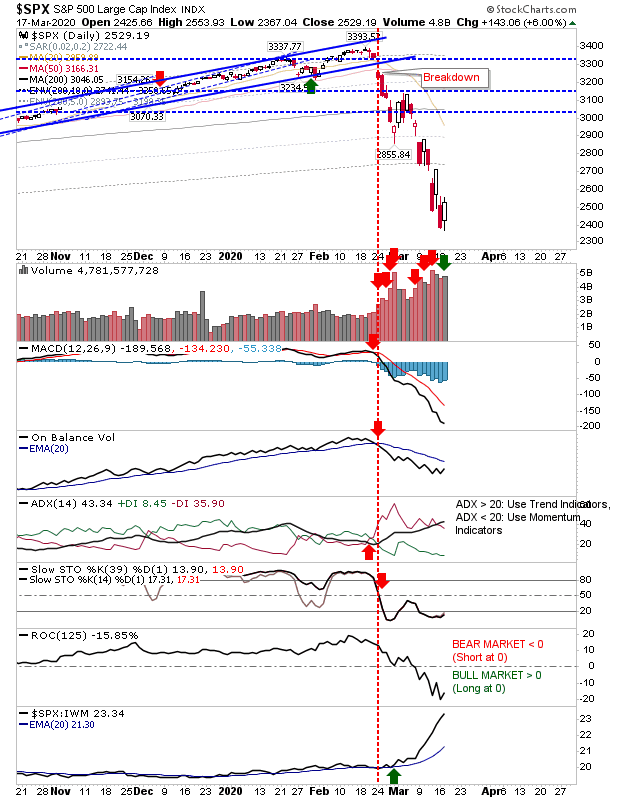

Wild intraday swings, but are prices clustering?

We are still in a hunt for a low but there is evidence that markets are finding some consolidation around recent price action - even if the range from high to low for this range is around 10%. The S&P finished with a bullish hammer on Wednesday on a high volume day, today was more of an indecisive 'spinning top' on lighter volume. The S&P is trading 20% below its 200-day MA but a bounce is needed; however, nobody knows when this bounce will emerge. Technicals are not offering much guidance yet.