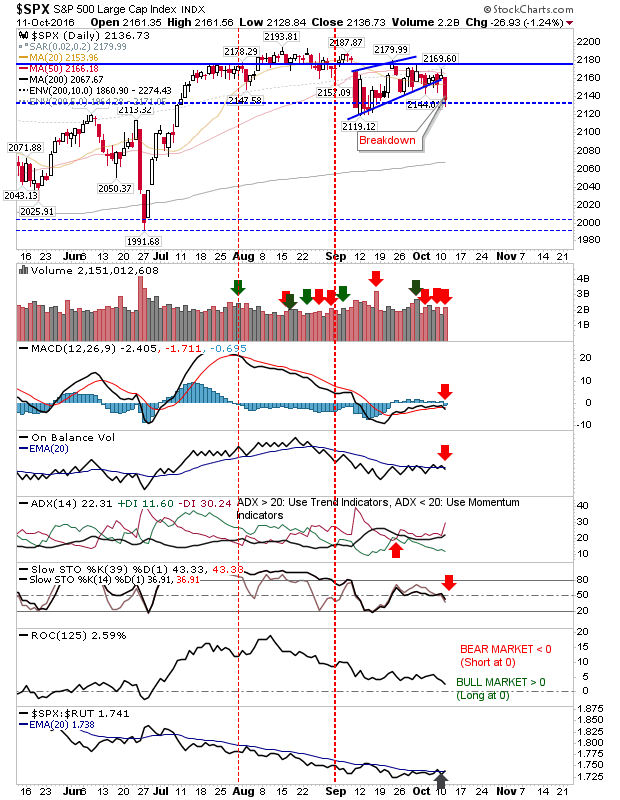

Sellers Hit Out

Today had the look of a decisive break down, but the last such breakdown from September's Brexit vote had a similar guise, but it failed to follow through. Volume climbed to register as another distribution day, the second (third for the S&P) such day since the last accumulation day. Tomorrow could be the decider, but it needs to break down right from the open - otherwise the agony will continue. The S&P is back showing net bearish technicals. However, the index continues to outperform the Russell 2000.