Tech is where the fun is.

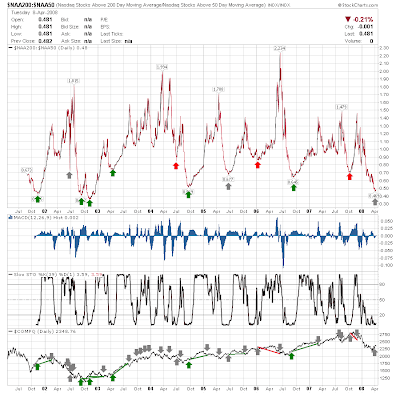

I had noted back in early December how the semiconductor index was due a bounce following some heavy overselling. It responded by falling even further to January lows, but was able to stabilize and rally back to its 200-day MA. During the run to the 200-day MA it has barely paused for breath, and bullish trend strength has been steadily increasing [+DI > -DI; ADX at 30 and rising]. This boundless energy has translated into a positive 2 months for tech averages: Money flow is very positive and the break of the 200-day MA should be enough to extend the rally a little further, as it has done in the Nasdaq 100: But Bill over at VixandMore makes a good case for at least taking some profits off the table . Get the Fallond Newsletter Declan Fallon is developing trading strategies, market indicators and sentiment tools for Zignals