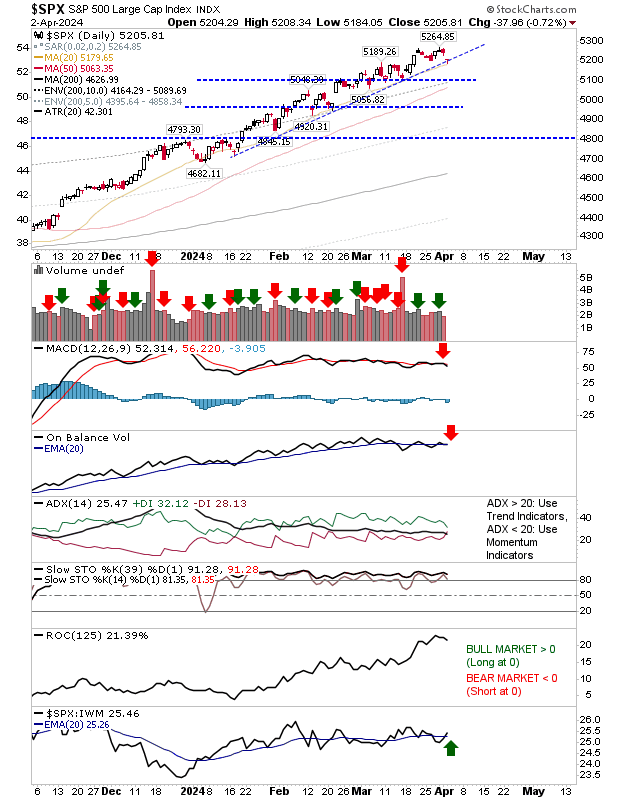

Russell 2000 ($IWM) finds support at rising trendline

There wasn't much volume to Friday's trading, but there was enough to see buyers come in a trendline support in the Russell 2000 ($IWM). There was no technical change to the index with only a whipsaw signal in relative performance against the Nasdaq, although the MACD remains on a prior 'sell' signal.