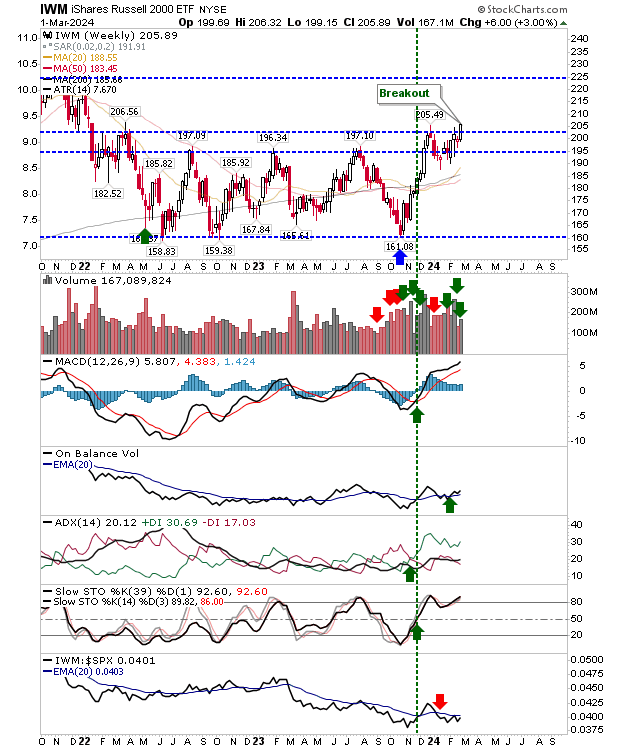

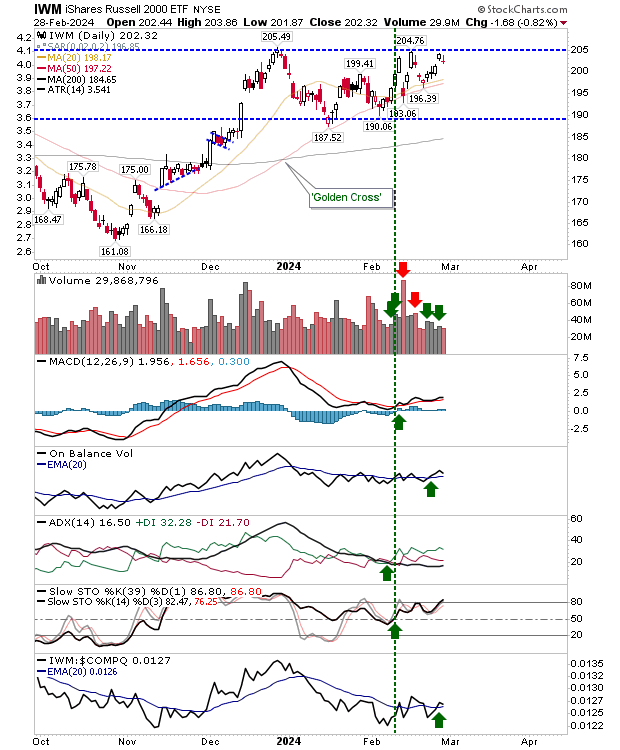

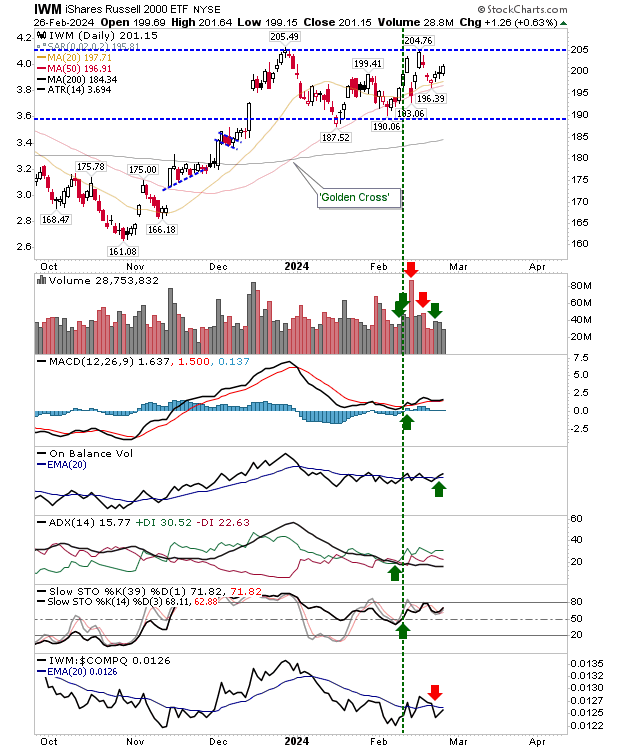

'Bull Traps' are still in play although today registered gains

Today was a bit of a mixed bag with all recording gains (good), but the Russell 2000 ($IWM) finished with a 'black' candlestick (close lesss than open price) that leaves bulls pressured and vulnerable to additiona losses. In the case of the Russell 2000 ($IWM), the losses were not huge and selling volume was light and below the previous day's buying volume. Technicals remained net positive. The 'bull trap' is still the favored outcome following today's action