A day the Russell 2000 ($IWM) shone

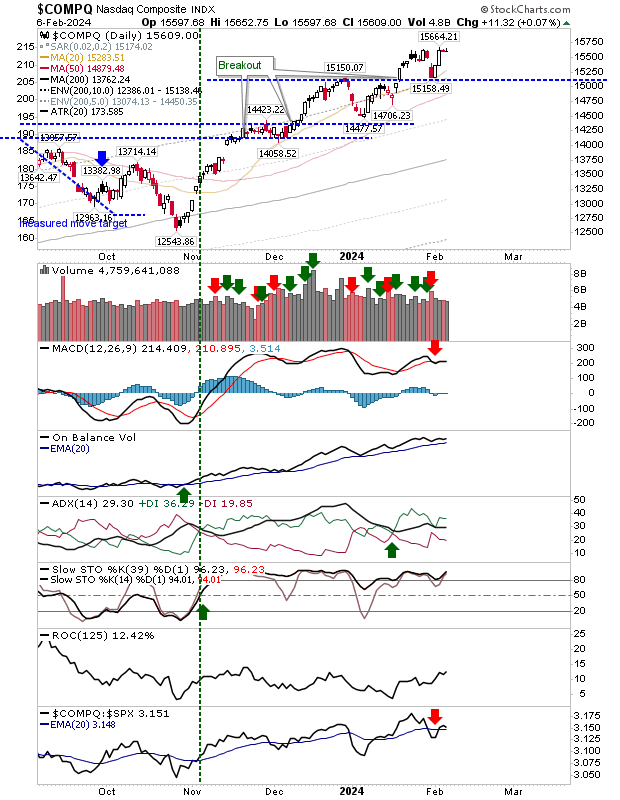

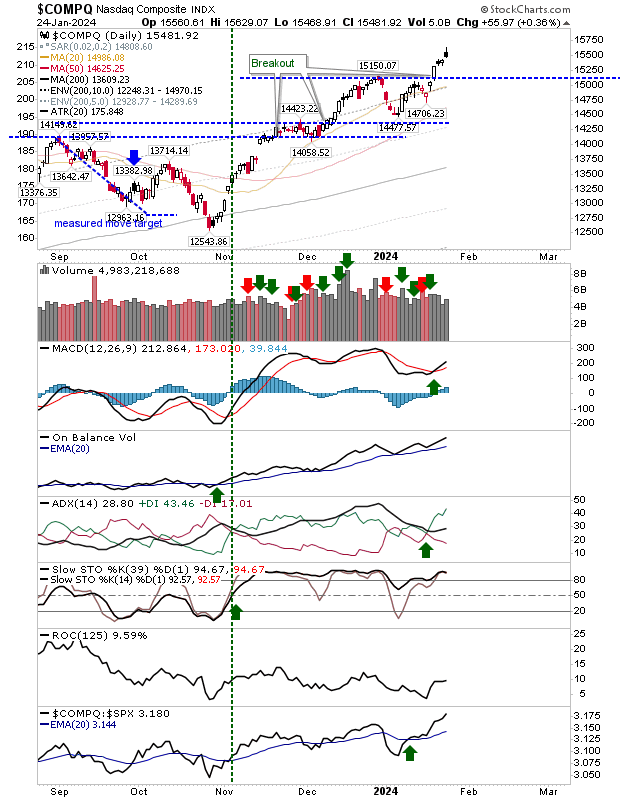

It was a real non-event for the S&P and Nasdaq, so it was left to the Russell 2000 to take up the slack. The Russell 2000 ($IWM) posted a solid gain to keep the momentum going from its successful 50-day MA test. If there was a concern it was that buying volume was a little disappointing, although today's trading registered as accumulation, continuing a trend of weakening volume since the initial sell off spike. Technicals for the Russell 2000 are also net bearish, despite today's gain.