Russell 2000 ($IWM) takes Monday's plaudits

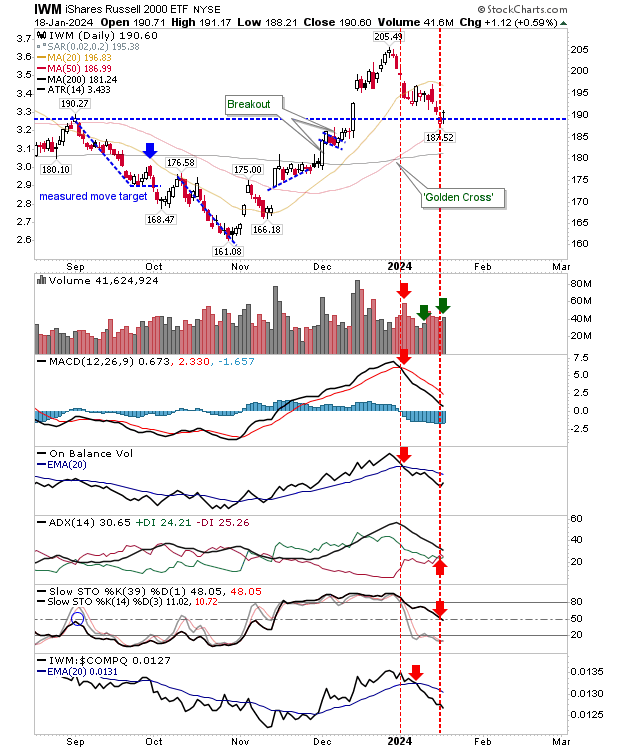

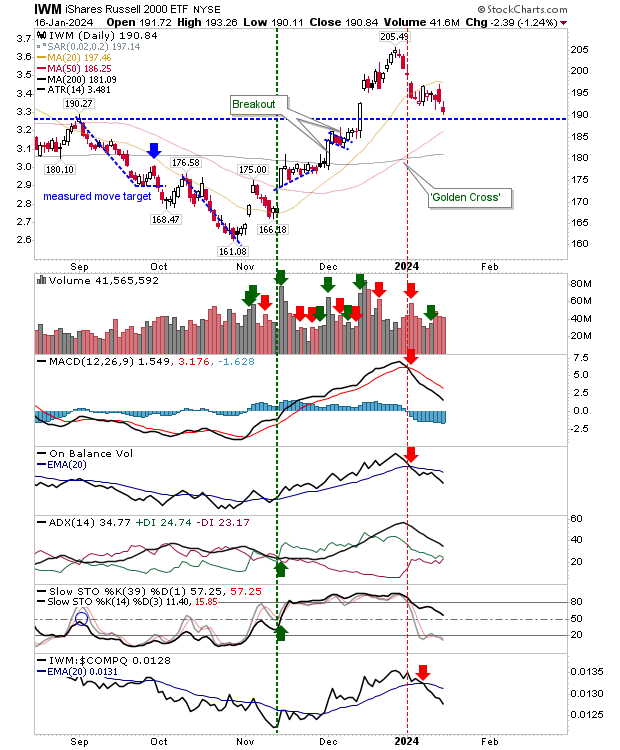

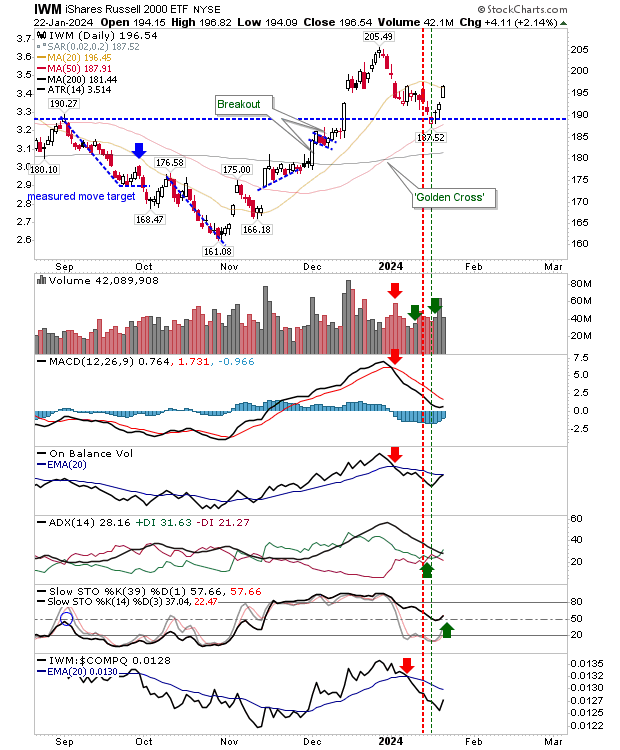

It was not a great day for my day-trading experiment as I got stopped out of my Russell 2000 long position, but it was the Russell 2000 that banked the best gain of the day. Buying volume was below Friday's but the index was able to close above its 20-day MA. Intermediate stochastics found support at the mid-line, and On-Balance-Volume is about to trigger a 'buy' signal, although it will be a few days before the MACD follows suit.