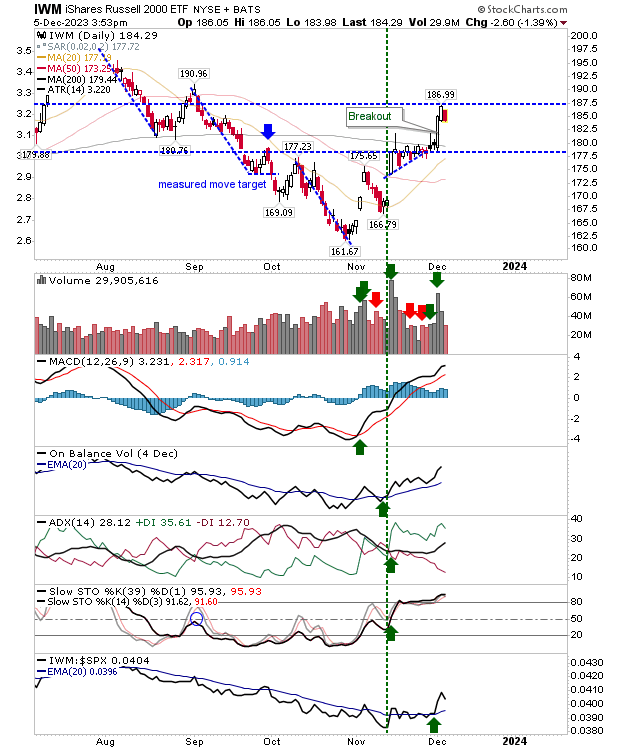

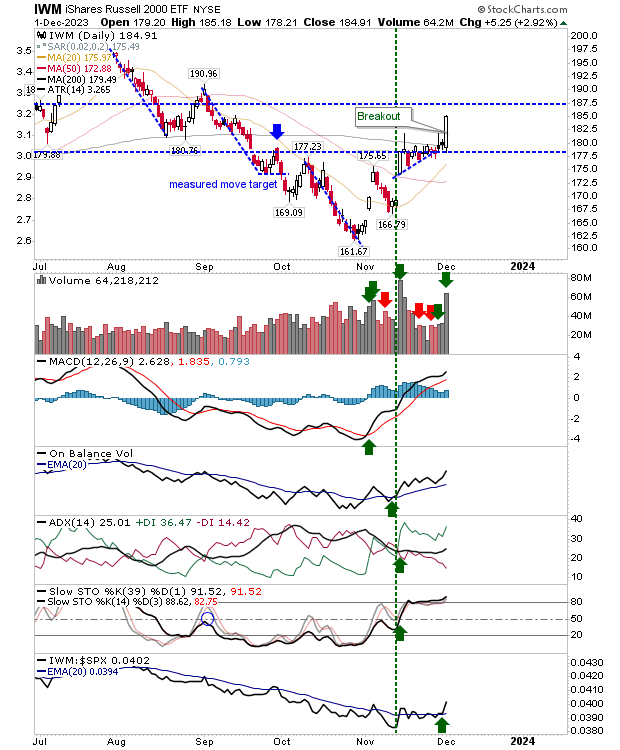

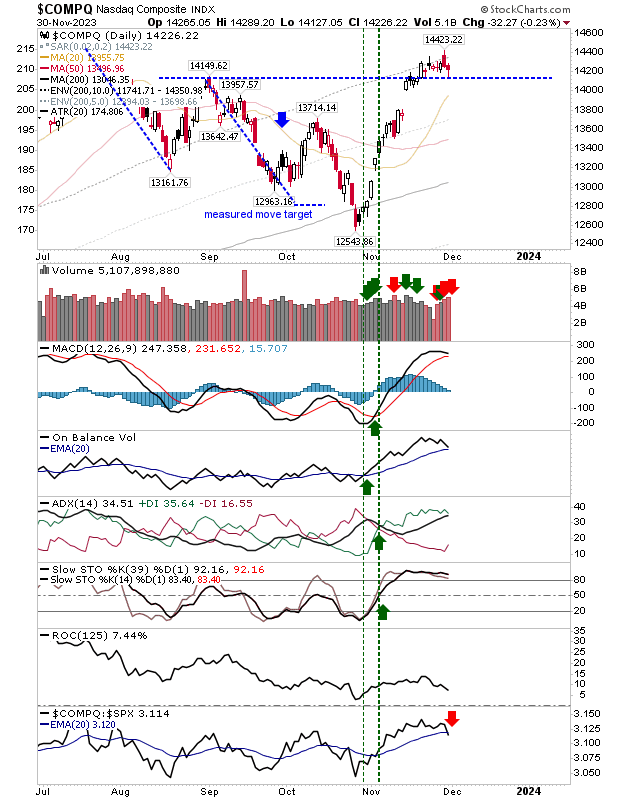

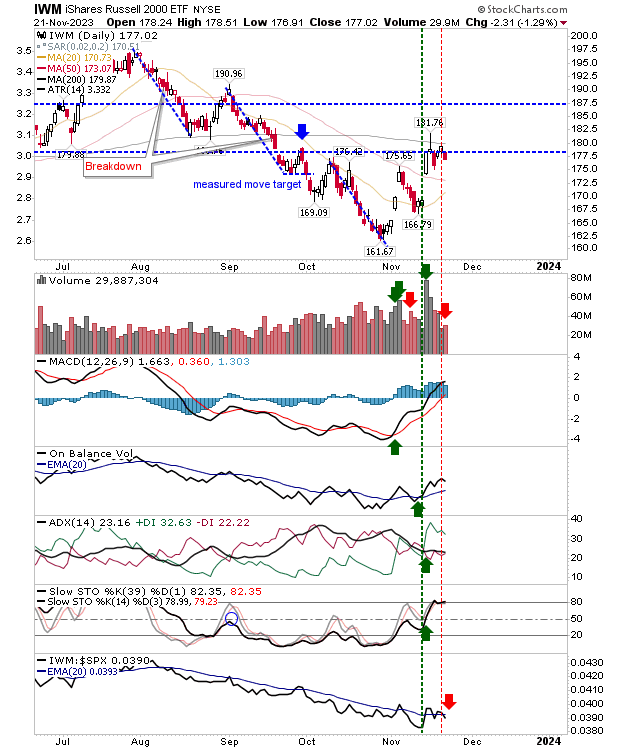

Tight trading near highs keeps momentum bullish for indices

Markets are trading near resistance defined by recent swing highs, reversing eary losses. The S&P opened on resistance and posted a small gain. The Nasdaq had opened at support and has moved to trading range resistance. In process of making today's gains there was a switch in relative strength back in favor of the Tech index. There is still a MACD trigger 'sell' to negotiate, but this signal occurred well above the bullish zero line.