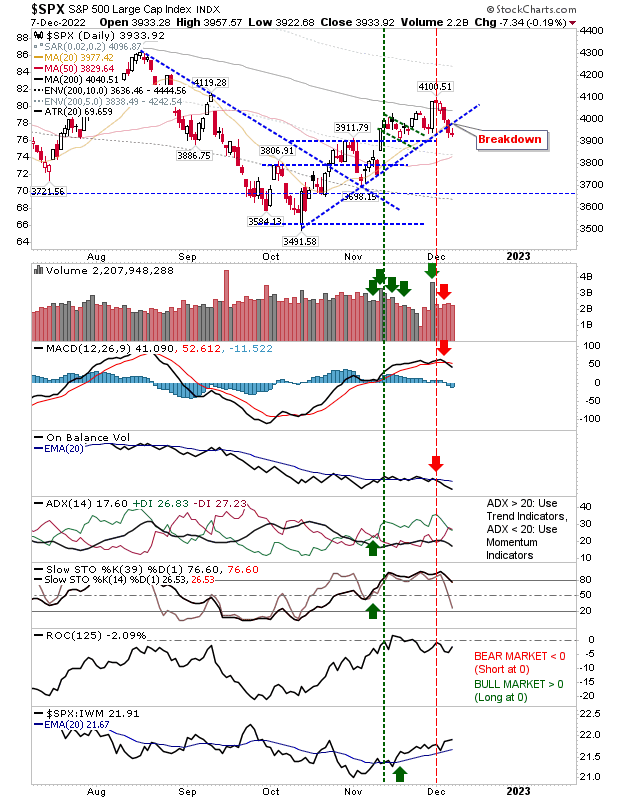

Has the S&P found support?

Each of the lead indices have their own support levels to defend, not all tested at the same time. On Friday, it was the Nasdaq toying with potential trading range support, today it's the turn of the S&P. These support levels I'm looking at are not major areas of demand, but a guide as to *where* demand might kick in. So with that, we have the S&P which is down testing neckline support from October with technicals net bearish, but not oversold. Price trumps technicals, so even given the weak technical picture there is a good chance we could see a bounce tomorrow - an aggressive long trade.