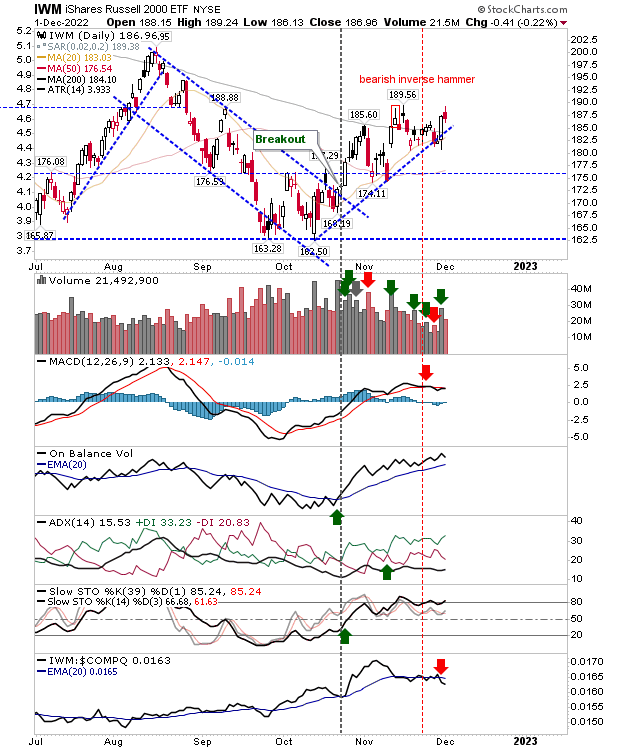

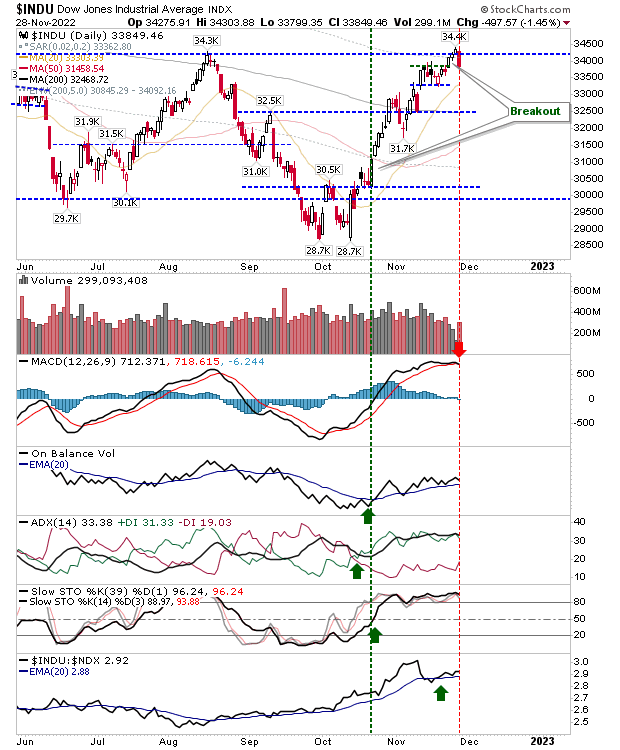

Weekly S&P Chart At Resistance

With the end-of-year fast approaching and Santa coming to town, all eyes will be on the S&P next week. This index finished the week on resistance in a set-up which offers a good chance by the close of business on Friday there will be a breakout. On the weekly chart, there was a MACD trigger 'buy' and On-Balance-Volume 'buy' to go with an upcoming out-performance against peer indices. Even if there is no price breakout this week, a close above the mid-line of Stochastics [39,1] would suggest a price breakout will be along soon enough.