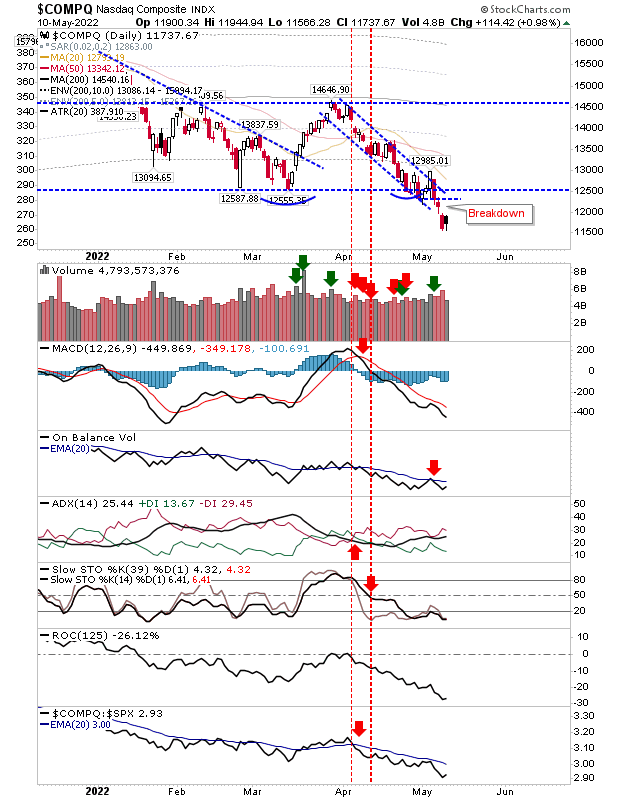

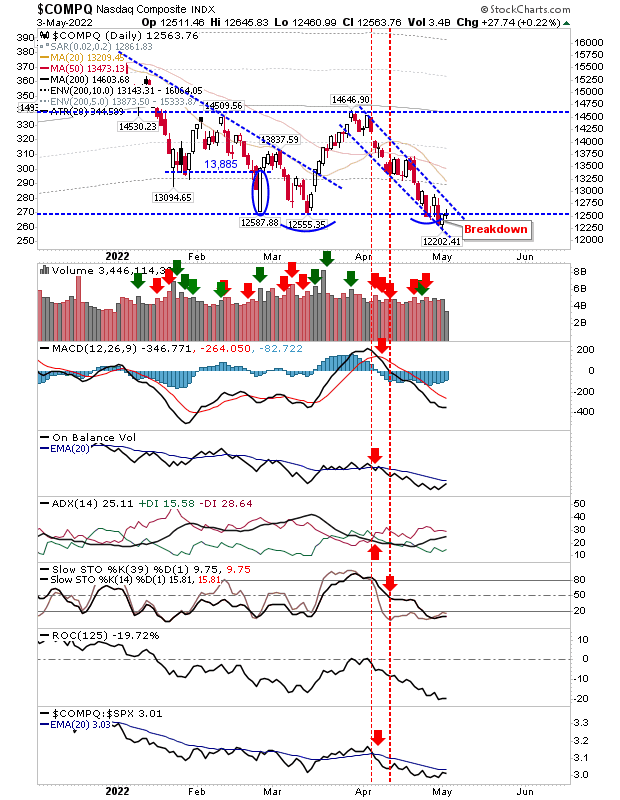

Market declines continue

With the losses adding up we can start tracking the relative performance of the indices against their 200-day MAs. We can see from the table below how the relationship of the indices to their 200-day MAs compare historically. The Nasdaq is 21.6% below its 200-day MA, which puts it into the 5% zone of historic price weakness and is a "Strong Buy". The S&P is 12.3% is below its 200-day MA, which is also in the 5% zone of historic weakness. Finally, the Russell 2000 is 18.4% is below its 200-day MA, which is also the 5% zone. For each index, we are repeating the action of the Covid 2020 sell off, and the Russell 2000 is only a few percentage points away from the 1% zone and a "Very Strong" buy.