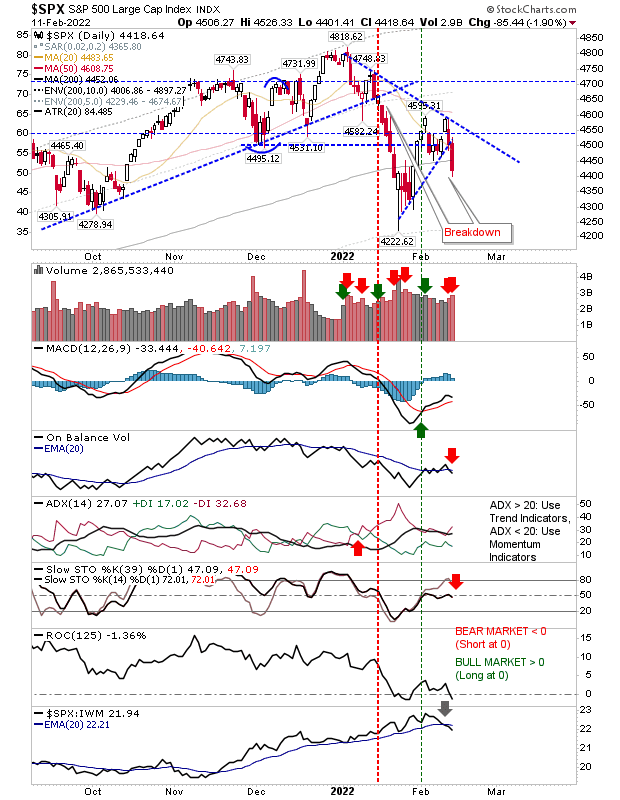

Trading Action Tightens As Selling Stalls (a little)

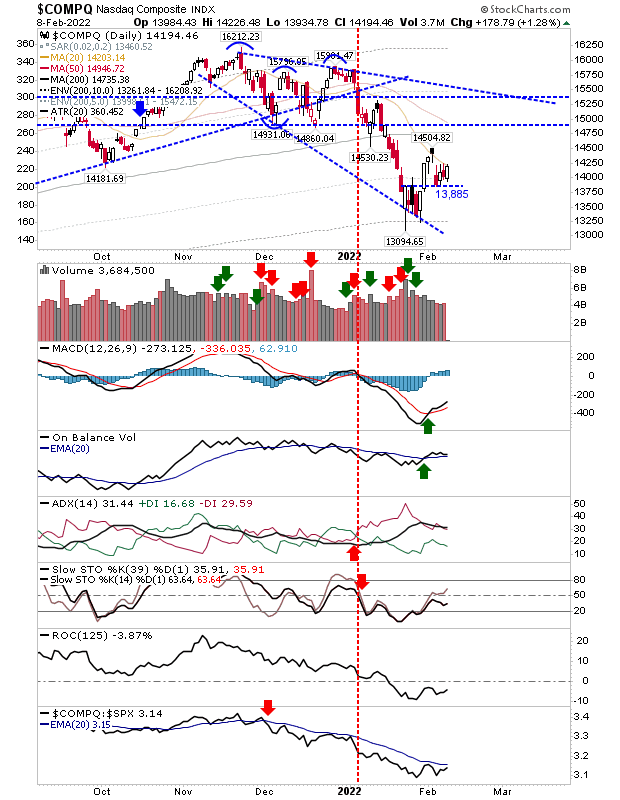

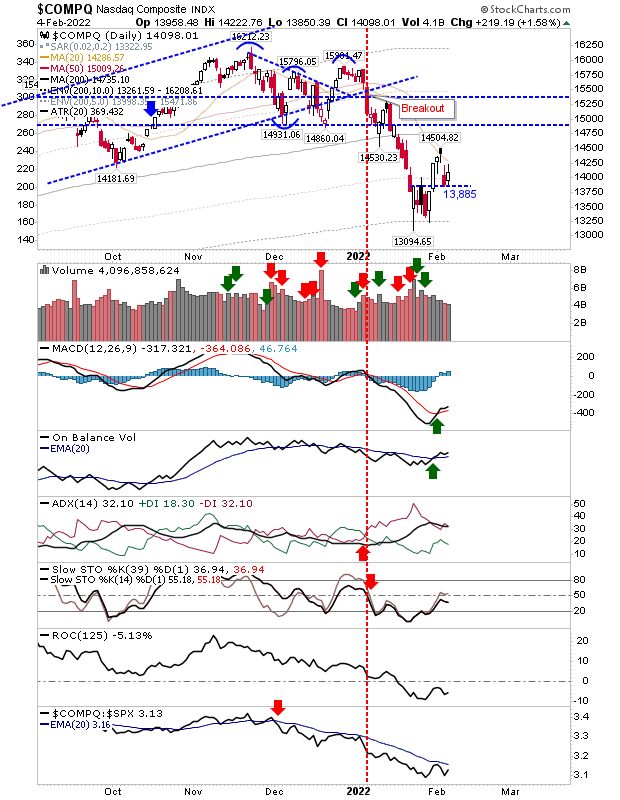

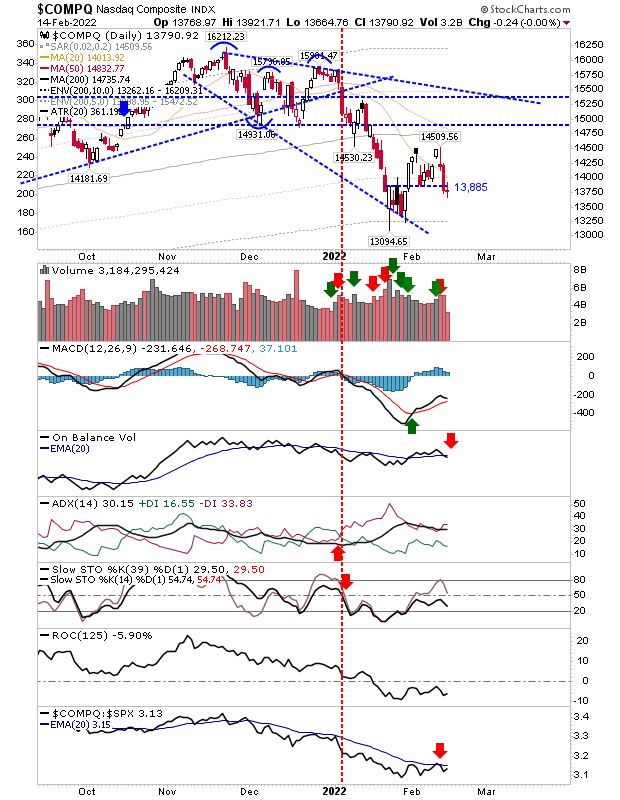

There wasn't a whole to today's action - which is probably a good thing. There was no follow through lower, instead markets traded in a more neutral manner with a set of narrow range doji. The Nasdaq held on to Friday's lows with a new 'sell' trigger in On-Balance-Volume. I have marked support at 13,885, but where it's out now is probably enough to consider it close enough to just support; a small gain tomorrow would be enough to regain this support.