Retest of January Lows to Commence

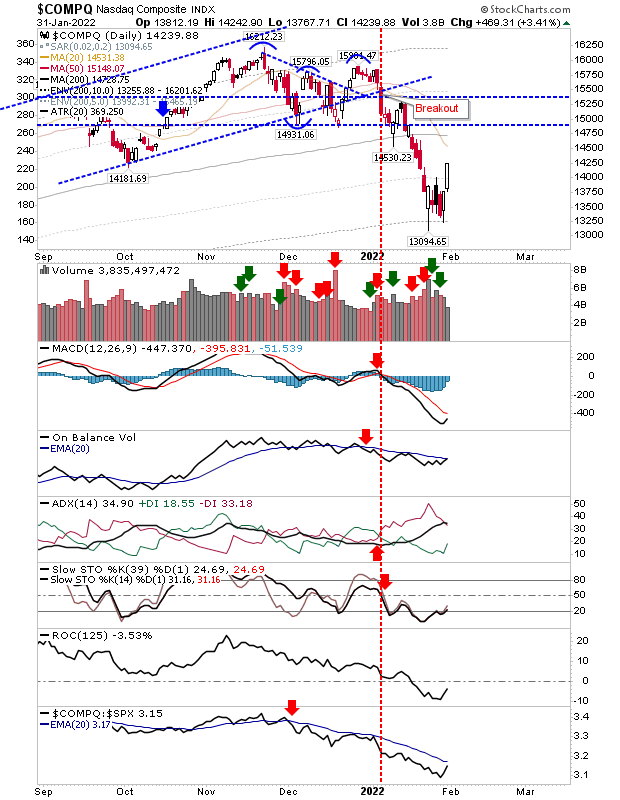

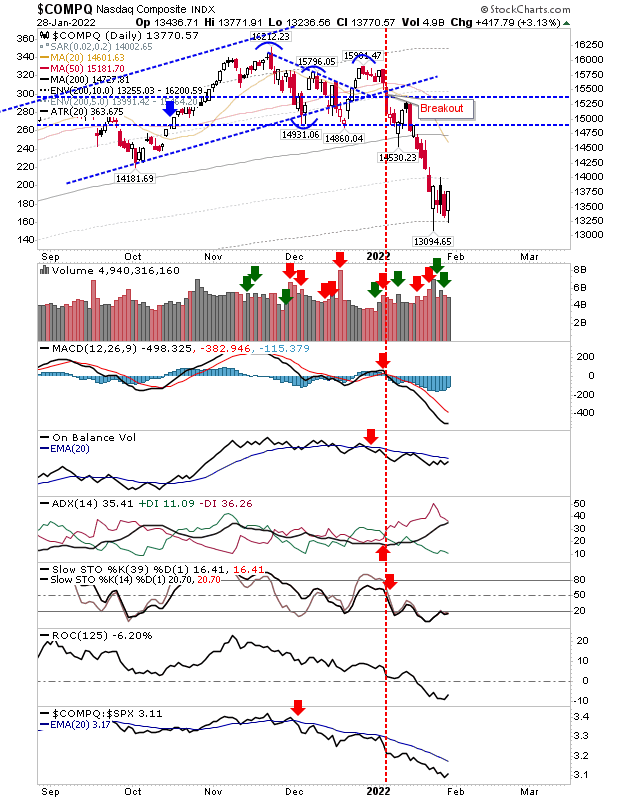

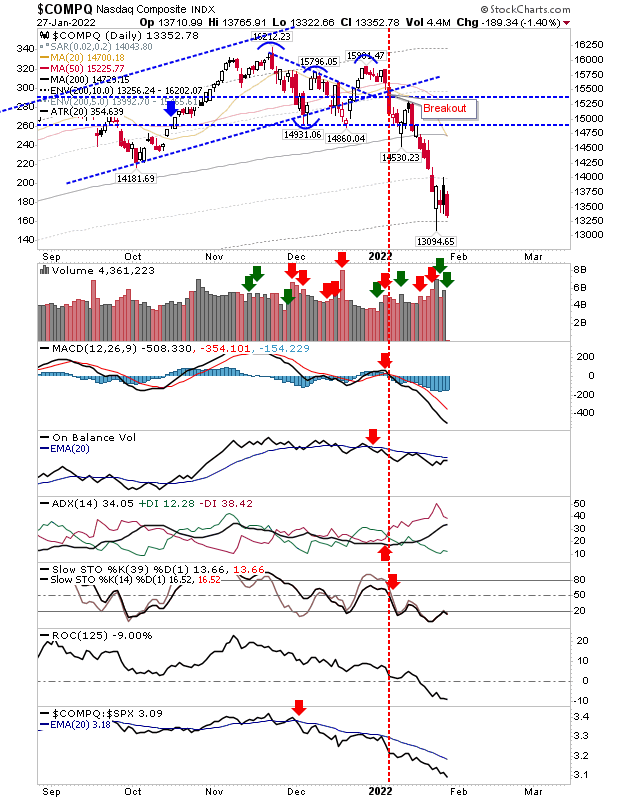

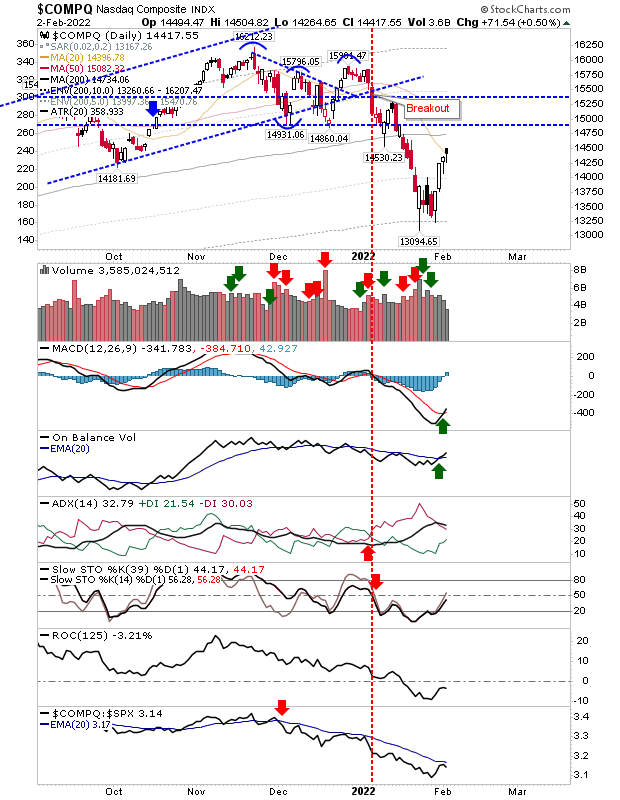

After some disappointing after hour earnings report we may see this market bounce move towards the next step, the confirmation test of the lows. Will markets confirm the January lows as a swing low, or will markets evolve into some broader measured move lower? In the case of the Nasdaq we had a narrow 'black' candlestick at the top of the bounce - and at 20-day MA resistance. Bulls can take some comfort with the MACD trigger and On-Balance-Volume 'buy' signals, although the former occurred well below the bullish zero line. A move down would not be surprising - the question is whether it will go all the way back to its 200-day MA.