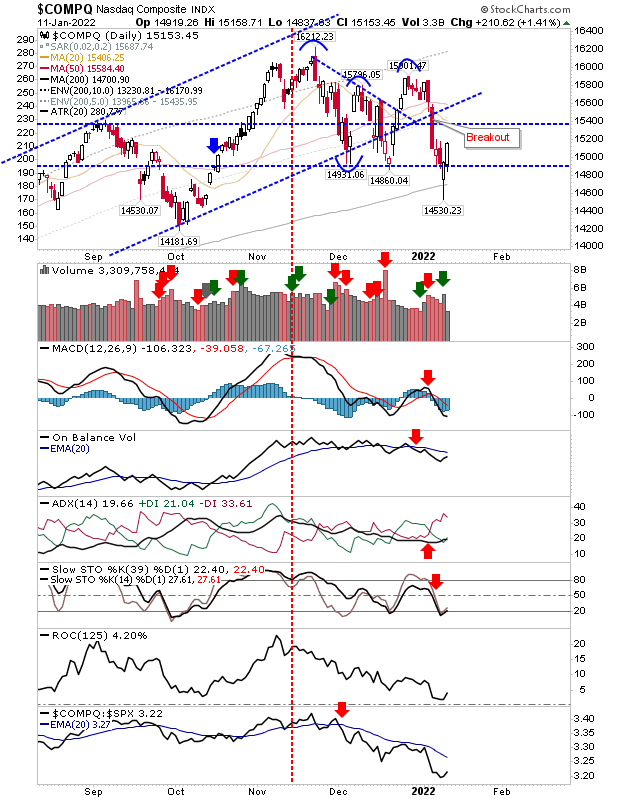

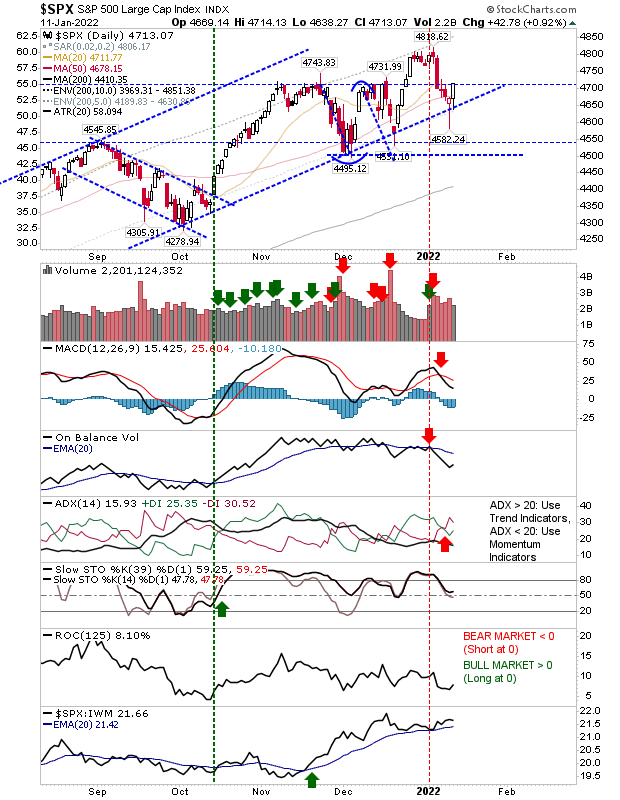

Swing Lows Take Shape Across Indices

Today effectively confirmed the swing low is in development across indices, but it's still early days if today's buying is to be reflected in a rally. The first challenge is to make it back to the last swing high.

For the Nasdaq, this means mounting a challenge of 16,000 as the 200-day MA has played as a launch point for this swing low. Technicals remain net negative.

The S&P continues to honor channel support (for a fourth time). Buying volume was down on yesterday but it was enough for it to close above its 50-day MA. Technicals are mixed, but stochastics are above the bullish mid-line.

The Russell 2000 defended the double bottom in what is now looking like a triple bottom. Technicals are net bearish but the index is outperforming the Nasdaq (but not the S&P). It shouldn't take much to make it back to a new test of its 50-day MA, but getting past it will be a more difficult task.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.