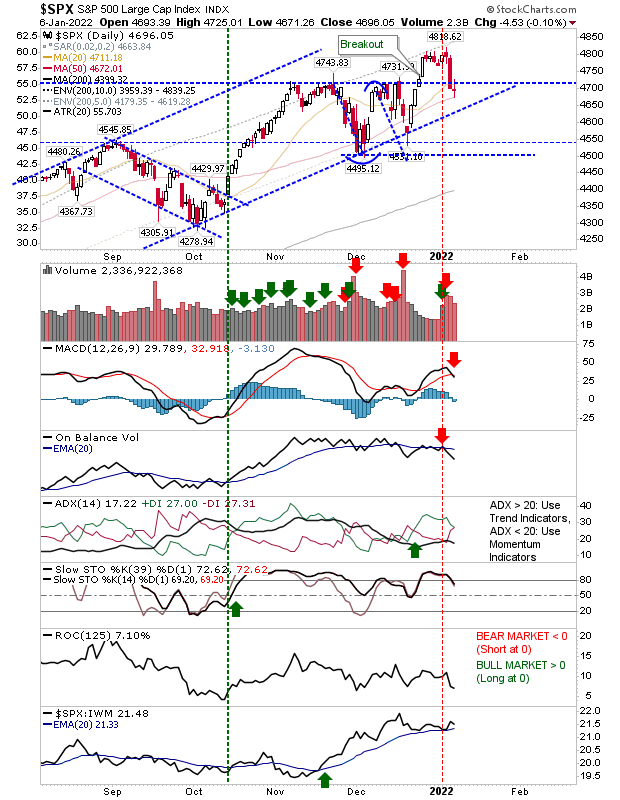

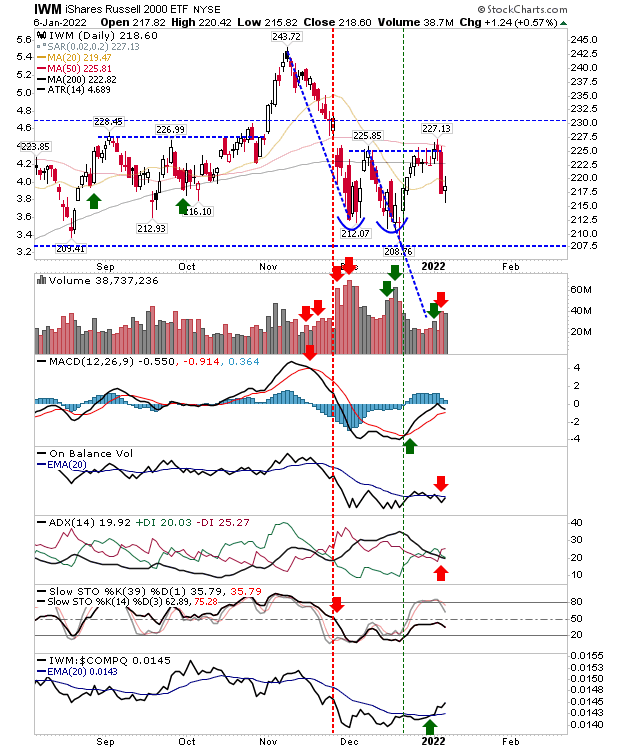

Sellers pay a visit, pushing markets back into prior ranges

One step forward, two steps back. The only consolation to today was that trading volume was down on yesterday's. The Nasdaq is holding circa 14,900 support whie the S&P was able to find buyers around its 50-day MA - but not before it undercut breakout support. Meanwhile, the Russell 2000 didn't make it past neckline resistance.

Despite the loss of breakout support the S&P has two chances to recover the losses; the first is where the index finished today - at its 50-day MA, the second is channel support - currently around 4,650. We do have 'sell' triggers in the MACD and On-Balance-Volume, but momentum remains on the bullish side of the midline.

The Nasdaq undercut rising channel support but did defend the swing lows from December, but just as triple tops are a rarity (i.e. breakouts usually occur on the third test of the double top), we have to consider we won't have a triple bottom - so look for a test of the 200-day MA. Technicals are net bearish and there is a sharp loss in relative performance against the S&P.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.