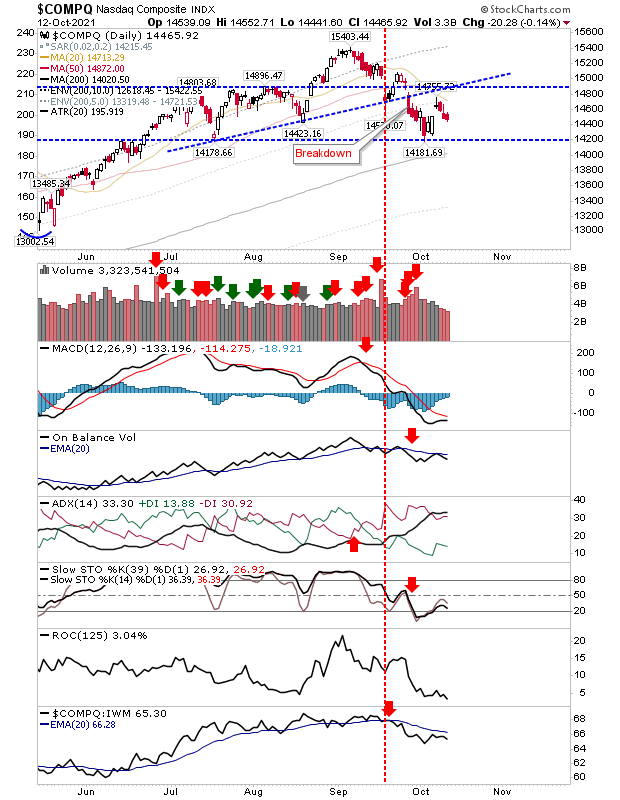

Beware the spike high...

Monday promised much - Tuesday provided an air of gloom. The S&P finished the day with a 'gravestone doji' which is ususally a bearish reversal candlestick. Adding to this is an overbought setup, which strengthens the reversal potential of the candlestick. If this is to play out then look for a lower close tomorrow, which collectively would also setup a 'bearish evening star'.