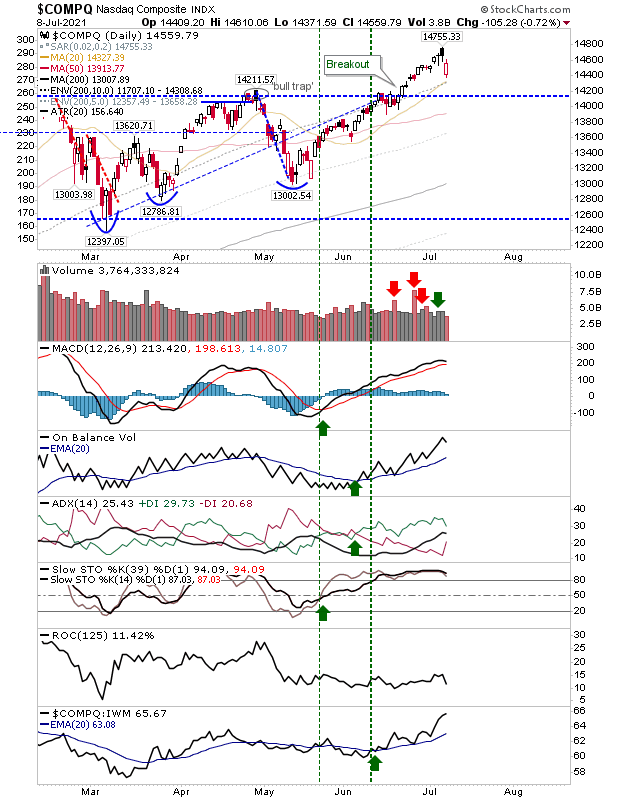

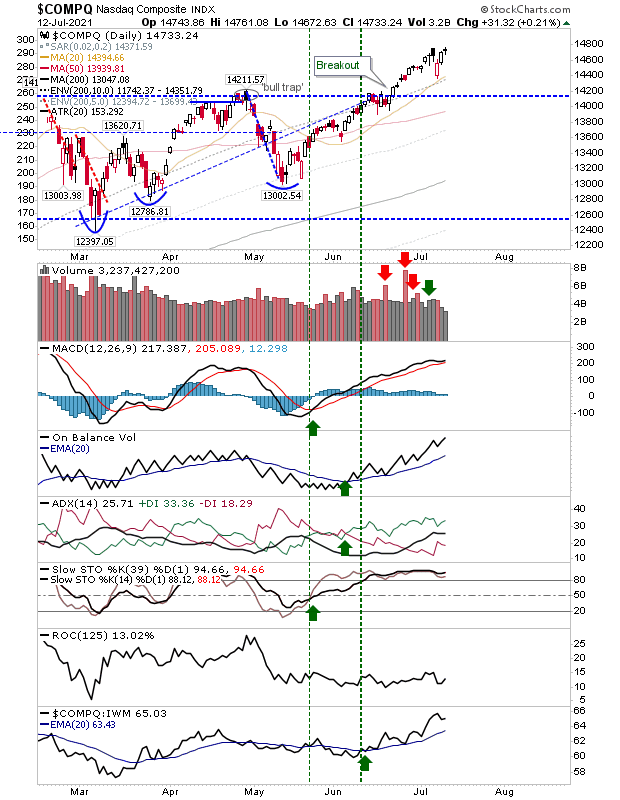

Markets edge a little higher, but larger picture unchanged

We are still seeing most of the leg work been done by Large Cap stocks while Small Caps remain caught within their base. Trading volume was below Friday's selling, and only the Nasdaq had action of note as today's doji left it bang-on the bearish black candlestick of last week; any gain tomorrow will negate this bearish candlestick.