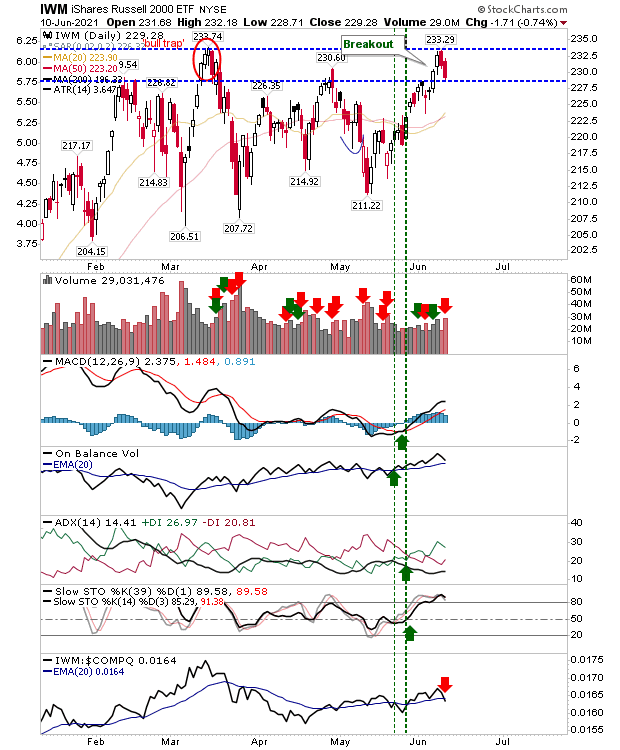

Small Caps confirm support with test

A bit of a mixed bag with the Russell 2000, having enjoyed prior strength, now finds itself in the process of back testing support - with the $229 level key. Volume rallied to mark distribution to go with a relative underperformance to the Nasdaq. Strength in the Russell 2000 is key for the broader averages but we need to see a bounce here if we are not to see a return to the prior trading range (of March-May).