Another low traffic day for the blog

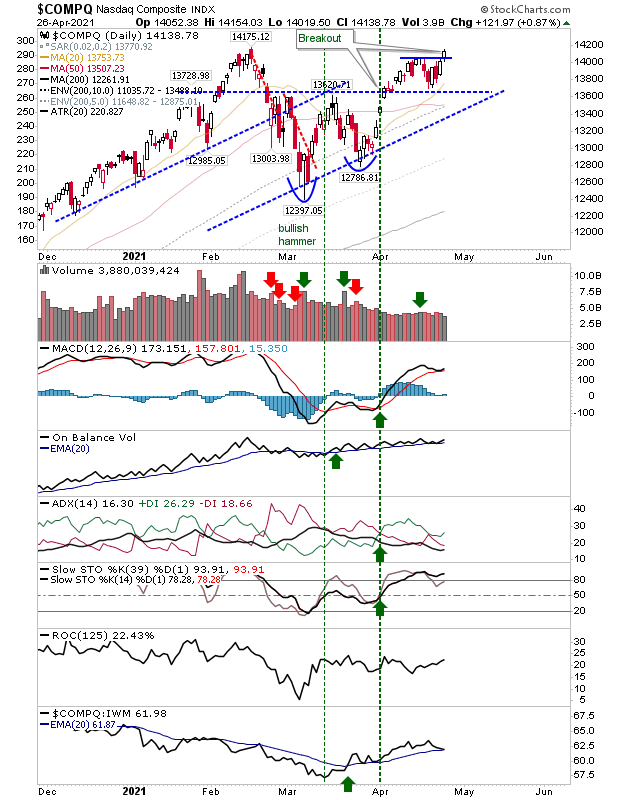

Markets do little, so blog traffic goes down. It's only when there is fear in the market does blog traffic spike. Today belonged to the low traffic day. The Nasdaq was able to hold above breakout support as it works to clear the February swing high. Technicals are still net positive, although there was a relative performance 'loss' versus the Russell 2000. Nothing to get too concerned about.