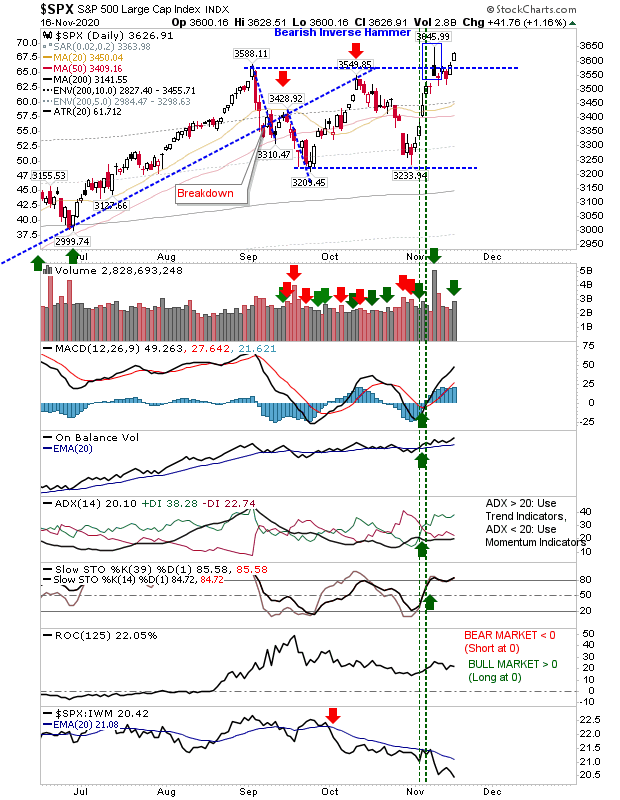

Today's action was quietly bullish. The fact none of the indices lost significant ground after pushing breakouts is of greater significance - suggesting few traders are willing to sell. As we approach end-of-year we have the Santa rally to look forward too. In reality, if sellers do make an appearance then we will want to see breakout support hold on a test (should a test occur). The Nasdaq is making up lost ground against the Russell 2000 as other supporting technicals remain net positive. The September high has been breached, neutralizing the outlook for a major top then, but with the index now riding 18.2% above its 200-day MA we now have to consider a new major top count; currently, we are in the 90% historic range of overbought action.