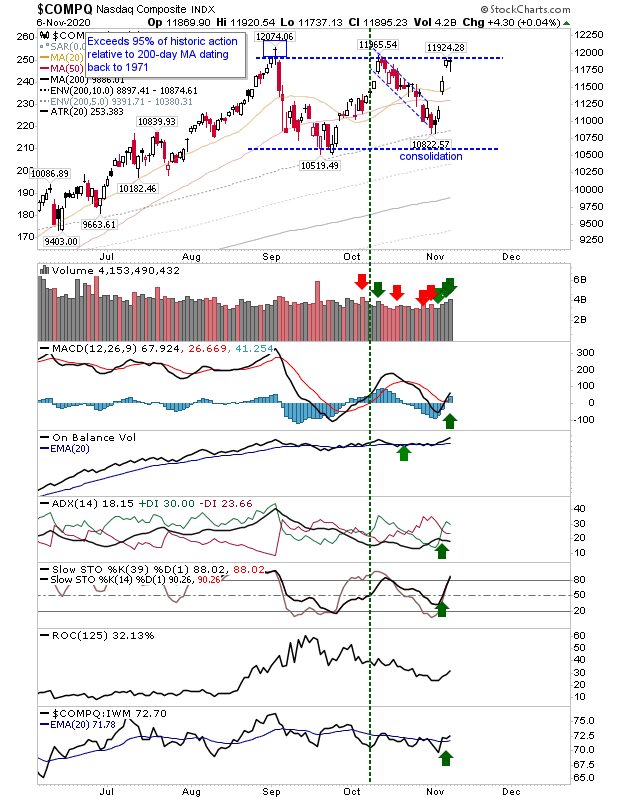

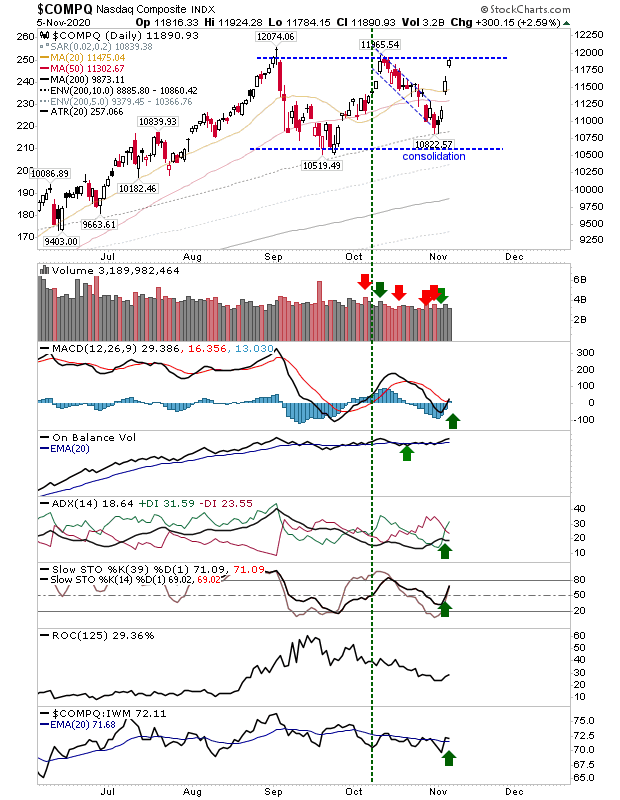

S&P and Nasdaq can't break September swing high

It was another struggle for the S&P and Nasdaq as they tried to get past the swing high of September. Only the Russell 2000 is showing signs of relative and price strength, which is good, but broader participation is required if those gains are to stick. The Nasdaq has fallen inside the prior trading range established from September. While triple tops are rare we are looking at the possibility of one here. Today's bullish 'hammer' may offer a launch point to challenge the bearish engulfing pattern high - which would be enough to restate a breakout. Not surprisingly, there was a large drop in relative performance to the Russell 2000.