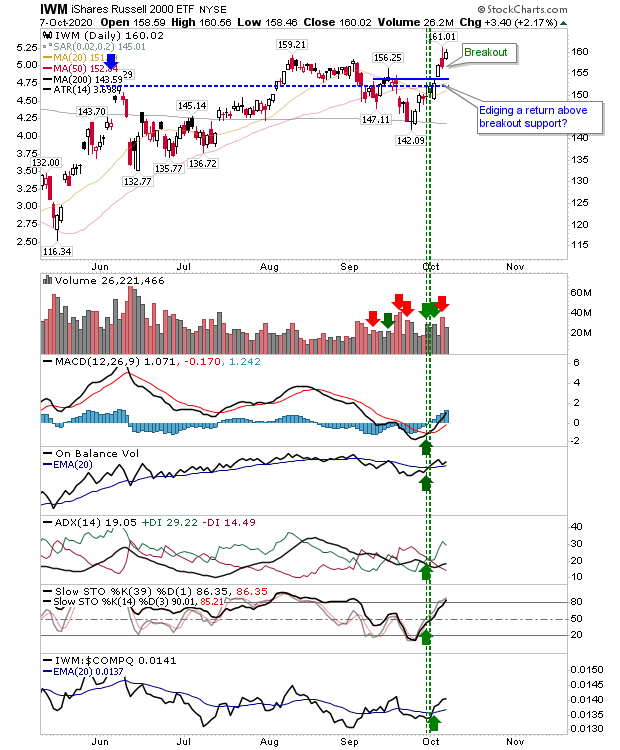

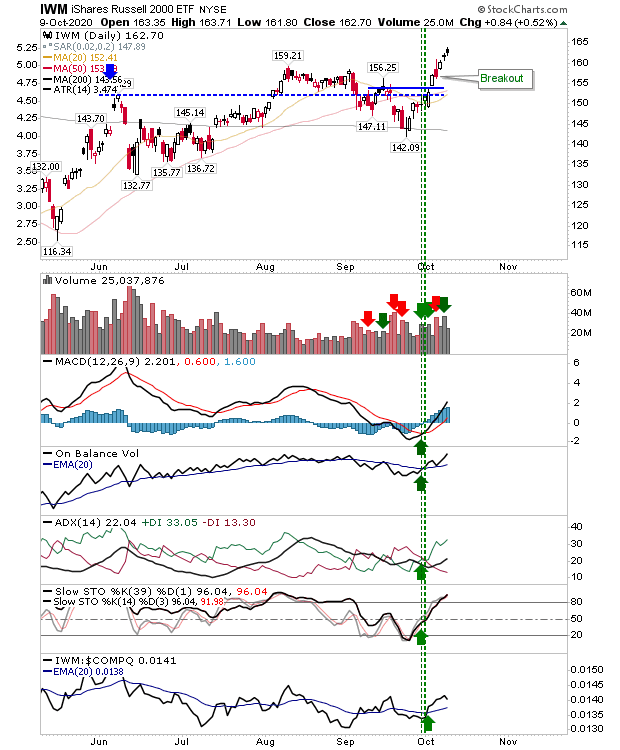

Russell 2000 Closes Week At New Swing High

Another day when Small Caps maintained their run of good form by closing above the August swing high, but buying volume was down on Thursdays. Technicals remain net bullish and have been since before the mini breakout in October. The only downside was the 'black' candlestick - a higher open but lower close; a close above prior day's close - 'black' candlesticks at a swing high typically mark reversals, so it will be important for buyers on Monday to make a close above the high of this candlestick to negate its potentially bearish implications.