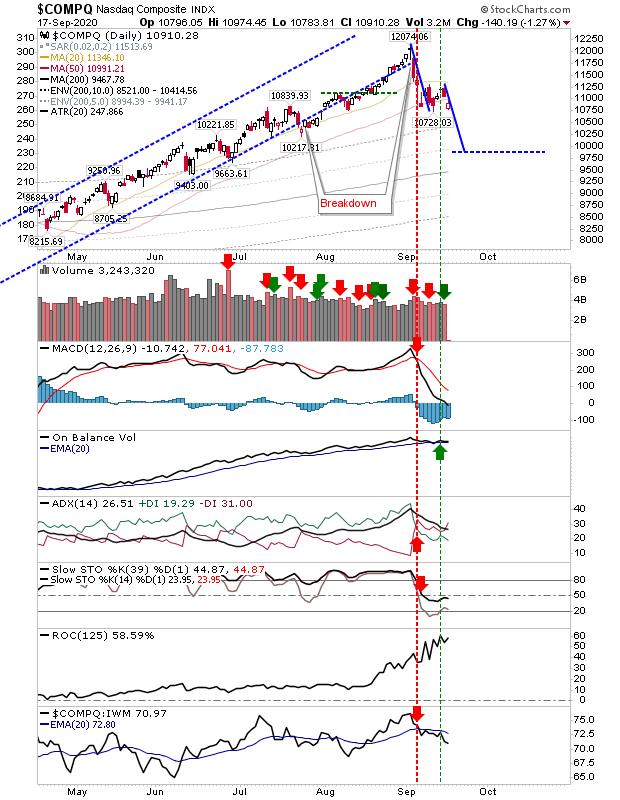

Selling Accelerates; Measured Move Targets Still In Play

Sellers again stamped their authority on markets with significant pushes lower which completely erased the weak buying of Tuesday. Markets remain on course to reach their measured move targets. The index closest to doing so is the S&P. No surprise to see technicals for the S&P net negative although the index continues to outperform speculative Small Cap stocks. Volume climbed to register distribution, an additional confirmation for today's selling. Once the measured move target is reached - likely tomorrow - next up will be the 200-day MA.