Buyers Keep The Pressure Up

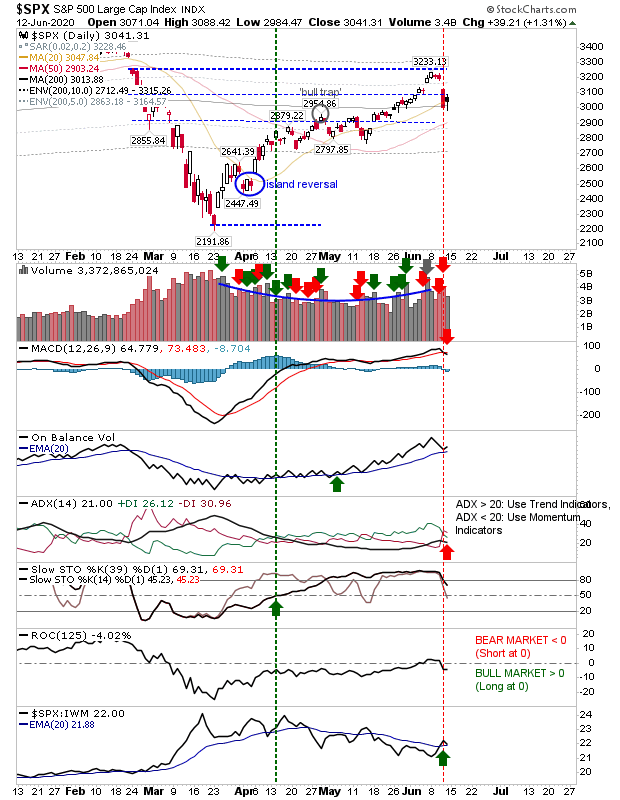

Friday's defensive action was followed by Monday's buying, with many indices defending 20-day MA support. The profit taking from Thursday is still in the mix but the panic selling from February hasn't materialized. Indices finished with possible bullish engulfing patterns, but the lack of oversold conditions weakens the signal. The S&P didn't reverse the 'sell' triggers in the MACD and ADX and left a new underperformance signal relative to the Russell 2000.