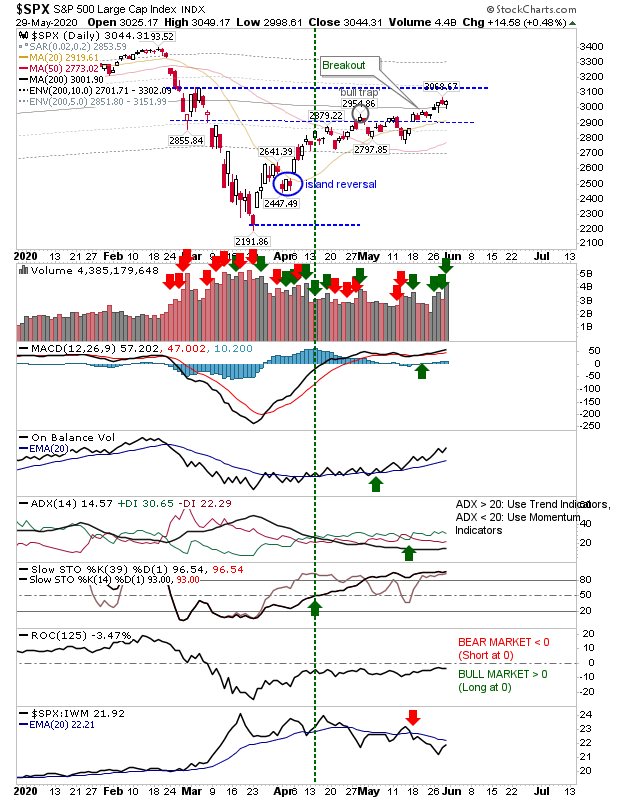

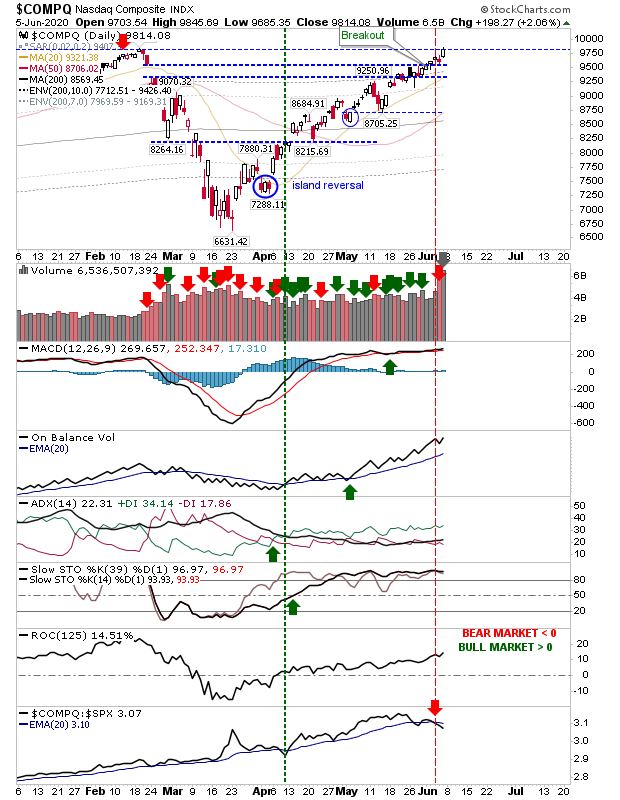

Markets Breakout On Jobs Data

Traders got the spin they wanted out of Friday's data which offered the impetus for the breakouts in lead indices. It's hard to understand how markets could perceive things as out of the woods but yet here we are, and you play the hand you are dealt. The pack leader is the Nasdaq as it closed on the February swing high - the next move will see it at all-time highs, following the lead of the Semiconductor Index. These gains have allowed the MACD to accelerate higher, taking it out of its flat line condition. Other technicals are very positive even though there is a relative underperformance against the S&P.