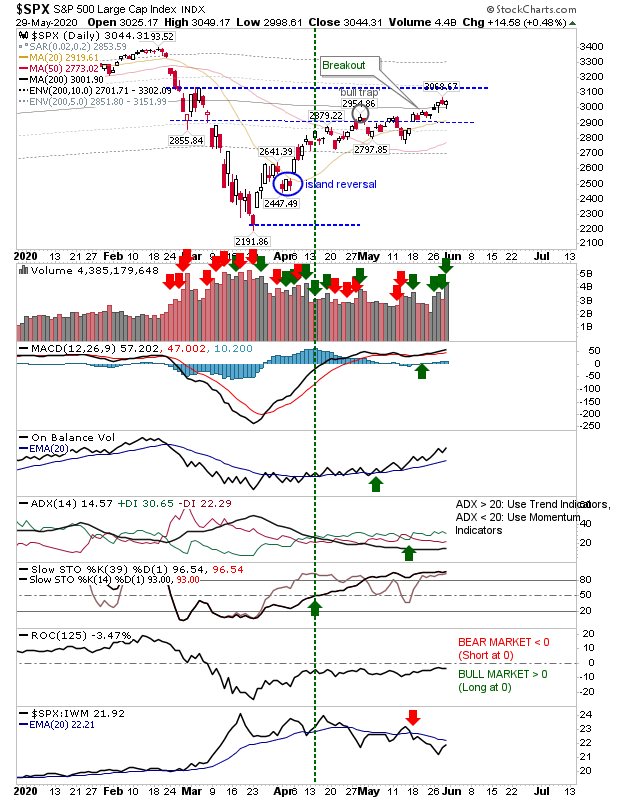

Markets poised for new round of breakouts

It was day which left lead markets poised for fresh breakouts as they finished on resistance or just above resistance (now support). The S&P ended the day just below the February swing high (around 3,130) as volume climbed in resistance driven profit taking (and also ranked as distribution). Technicals, aside from relative performance, are all bullish and show no signs of divergence; so the expectation would be for resistance to breach.