Small Caps Continue to Make The Running

The Market has finally noticed the value in Small Caps and added nearly 5% in a drive towards its 200-day MA. The index is still lagging a long way behind the Nasdaq and S&P but has at least enjoyed a relative performance advantage.

The S&P manage to make a breakout on higher volume accumulation, although the price gain was relatively modest it did manage to edge beyond the February swing low. The 200-day MA is the next target. Supporting technicals are bullish, although it continues to lose relative ground against the Russell 2000.

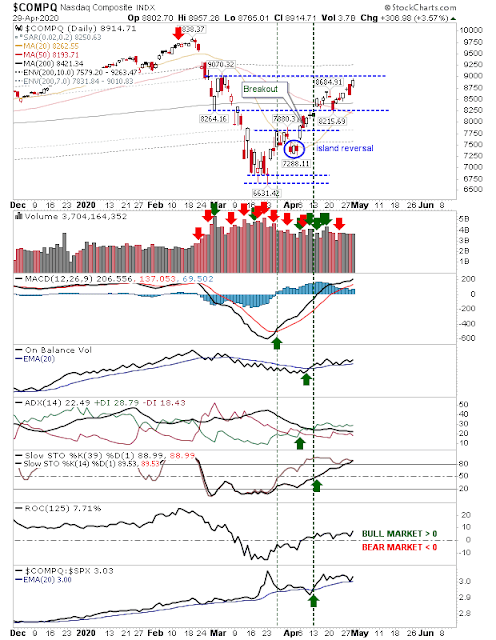

The Nasdaq was in the middle of the action with a 3.5% gain as it works its way towards the February swing high. If it gets that far, then the next target is the February gap down and then all-time highs; the latter feels like a stretch but the market does what the market does.

Supporting the Nasdaq was the gain in the Semiconductor Index. The index is knocking off the various resistance levels and is now left with just the February breakdown gap before all-time highs are again challenged.

The rally continues and despite the negativity in the news cycle the market keeps climbing higher. Small Caps are finally seeing some traction and this is important for the sustainability of the rally.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.