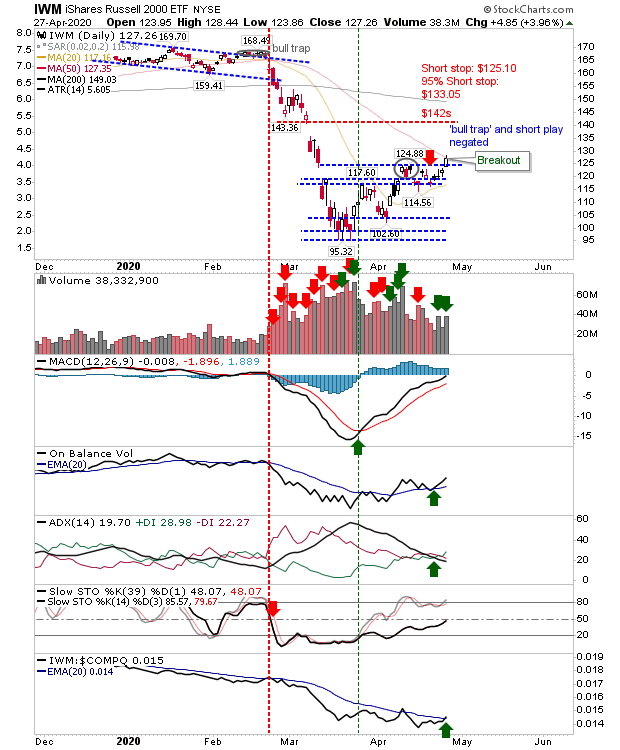

Small Caps Continue to Make The Running

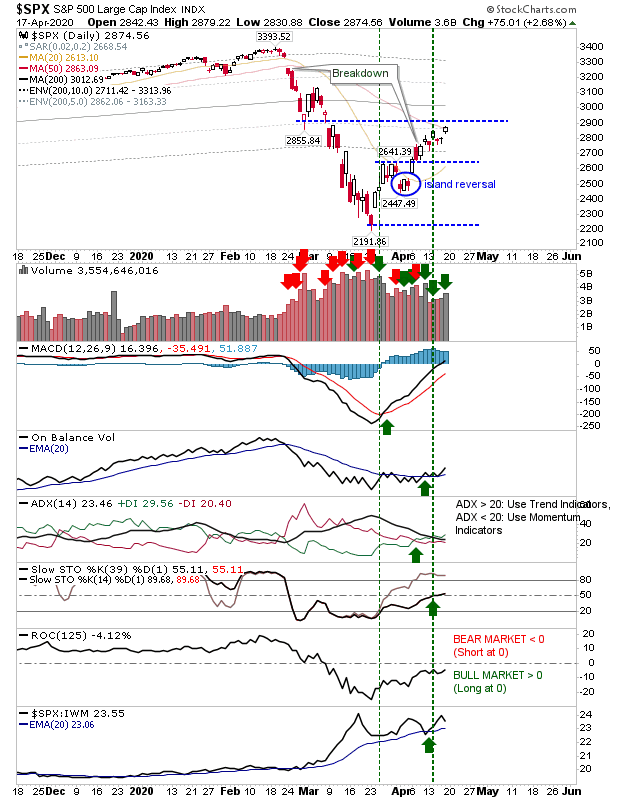

The Market has finally noticed the value in Small Caps and added nearly 5% in a drive towards its 200-day MA. The index is still lagging a long way behind the Nasdaq and S&P but has at least enjoyed a relative performance advantage.