Kx Product Insights: Technical analysis of financial markets, what’s it all about?

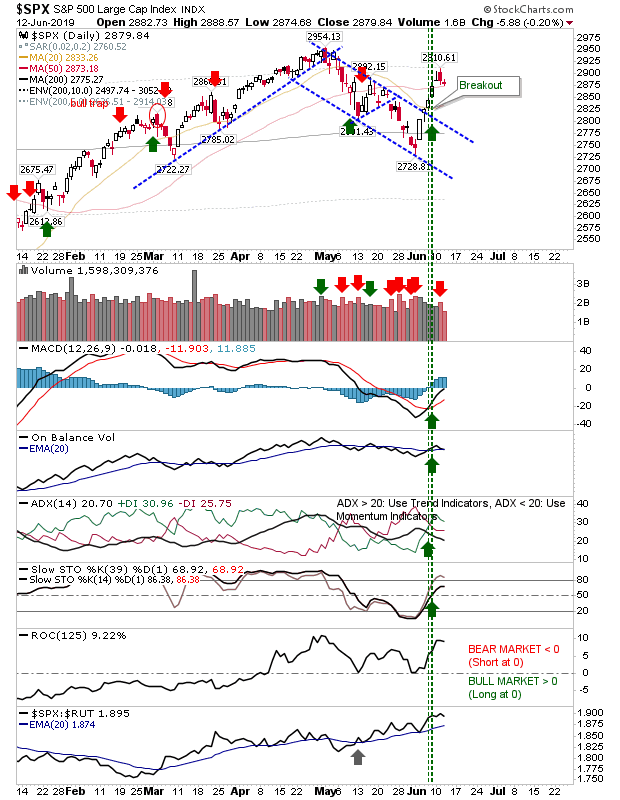

One of my pieces I wrote for the Kx Systems Insights blog: "For this month’s blog post we will delve into the mysteries of technical analysis of financial markets. Kx Dashboards come with two built-in financial charting packages which can be used to demonstrate technical analysis. In this article we will use the Financial Chart component. Our next article will look at some of the tools in ChartIQ." Read More