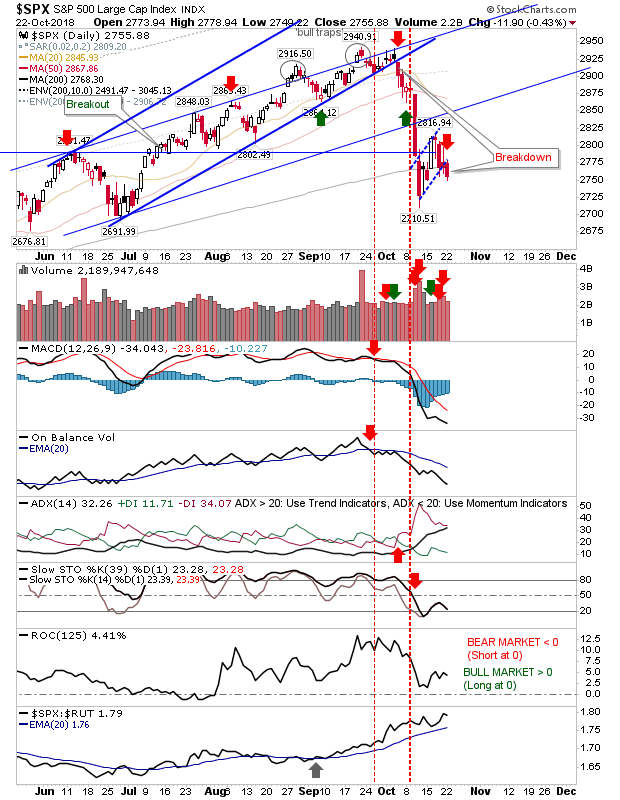

Since the last update indices got their bounce but the last couple of days have seen these gains gradually erased. Over the course of the week, the entire bounce has the look 'bear flags' as part of larger measured moves lower. Should this emerge then indices will be close to offering the long term 'buy' signals I track in the tables below every blog post I make (available on markets.fallondpicks.com for syndicated content). Last of which for all three indices was February 2016 For the S&P, the measured move target is 2,585. This comes on a day of higher volume distribution with an acceleration of On-Balance-Volume lower and other technicals net bearish. However, relative performance is accelerating higher (vs Small Caps) and the index is clinging on to its 200-day MA